Sailboat Loan Calculator: Chart Your Course to Ownership (Even in Canada!)

Hey there, dreamers and future sailors! Sami here. If you’re anything like me, there’s nothing quite like the idea of slicing through the waves with the wind in your sails and the sun on your face. You’re right! Owning a sailboat truly is a lifestyle, not just a purchase. But let’s be real for a second: turning that dream into reality usually means diving into the world of financing. And honestly? It can feel more confusing than reading a nautical chart upside down.

When I first started thinking seriously about getting my own sailboat, the excitement was real. But the numbers? Not so much. Between the price tag, interest rates, taxes (especially here in Canada), and what my monthly payments might look like—it felt overwhelming. I didn’t just want to guess. I needed clarity. I wanted to feel confident that I could afford it, not stressed every time I thought about it.

⛵ Sailboat Loan Calculator (Canada)

Chart your course to sailboat ownership with confidence

Sailboat Details

Excluding GST/PST/HST

Typically 10-20% of purchase price

Loan Terms

Current rates: 7-10% for good credit

Additional Fees

Loan Summary

Estimated Payment

$0.00

per month

Tax Breakdown

Amortization Preview

Note: This calculator provides estimates only. Actual terms may vary based on credit approval.

Rates current as of 2025. Non-taxable fees may include documentation fees. Taxable fees may include registration.

That’s exactly why a Sailboat Loan Calculator is such a game-changer. It’s not just some boring financial tool—it’s your personal guide. It shows you what to expect, how everything adds up, and helps you figure out if your dream fits your budget. Let’s break it down and see how it helps you set sail, the smart way.

What Is a Sailboat Loan Calculator and Why Should You Care?

In plain terms, it’s a tool that helps you figure out how much your boat loan will actually cost you—monthly and overall. It’s like having a trusted navigator who lays everything out in simple numbers. With it, you’ll be able to answer big questions like:

- What’s my estimated monthly payment? That’s often what people are most curious about right away. The calculator tells you exactly how much you’ll be paying each month, including all the extras.

- What’s the total interest I’ll pay? This one’s huge. This calculator helps you see the true cost of your loan over time, not just the initial price.

- What’s the full cost of the boat? Not just what it says on the website, but the actual all-in cost including interest, taxes, and any fees.

- How do my down payment and trade-in help with the loan? You’ll see immediately how putting down a little more cash or trading something in lowers your overall loan—and your monthly payment.

- How do Canadian taxes affect the loan? Yep, we Canadians have to deal with GST, PST, HST, and QST depending on the province. A good calculator factors all that in so there are no surprises.

Bottom line: This calculator helps you go from guessing to knowing. And that’s the first step toward smart boat ownership.

Read this Article: Boat Loan Calculator

How to Use a Sailboat Loan Calculator (Step-by-Step)

Ready to see how it works? Here’s how you can use a sailboat loan calculator (like the one on Easyloancalc.com) to get a clear financial picture of your future sailboat.

Sailboat Info

Purchase Price (Before Tax)

This is the actual cost of the boat, before you tack on any taxes. Ask your dealer for the “before tax” number to get it right.

Down Payment

This is the cash you’re paying up front. The more you put down, the lower your monthly payments and overall interest will be. Even a few thousand dollars can make a big difference. I know it did for me.

Trade-In Value

This is the value you get for trading in your car, RV, or old boat. It directly cuts down on how much you’ll need to finance.

Amount Owed on Trade-In

If you still owe money on that trade-in, enter that here. It’ll be deducted from the trade value to calculate what you’re really gaining.

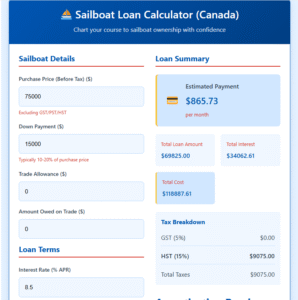

Loan Details

Interest Rate (APR)

This is what the lender charges you. With good credit, you might get something between 7–10%, depending on the lender and whether the loan is secured.

Pro Tip: Don’t settle for the first rate offered. Compare quotes from banks, credit unions, and marine finance specialists.

Loan Term

This is how many years you’ll be making payments on the loan. For boats, it’s pretty common for loans to last anywhere from 5 to 20 years.

My Take: I considered 20 years at first (lowest monthly payments, right?), but then I looked at the interest—yikes! I chose 15 years instead. A bit higher monthly cost, but way more savings over time.

Province

This one’s especially for Canadian buyers. Tax rules vary widely across provinces. Your calculator will apply the correct GST, PST, HST, or QST based on where you live.

Payment Frequency

You get to pick how often you make payments—monthly, twice a month, every two weeks, or weekly—whatever works best for your budget.

Additional Costs

Non-Taxable Fees

Stuff like registration or admin fees that don’t include sales tax.

Taxable Fees

Dealer prep, documentation, and any other fee where sales tax applies.

Once you enter all the numbers, hit “Calculate” and boom—you get the full breakdown. Want to try different setups? Just hit “Reset” and tweak the numbers.

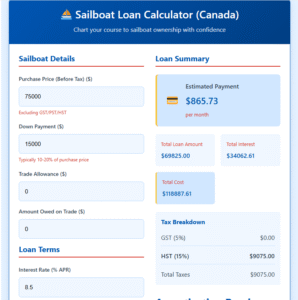

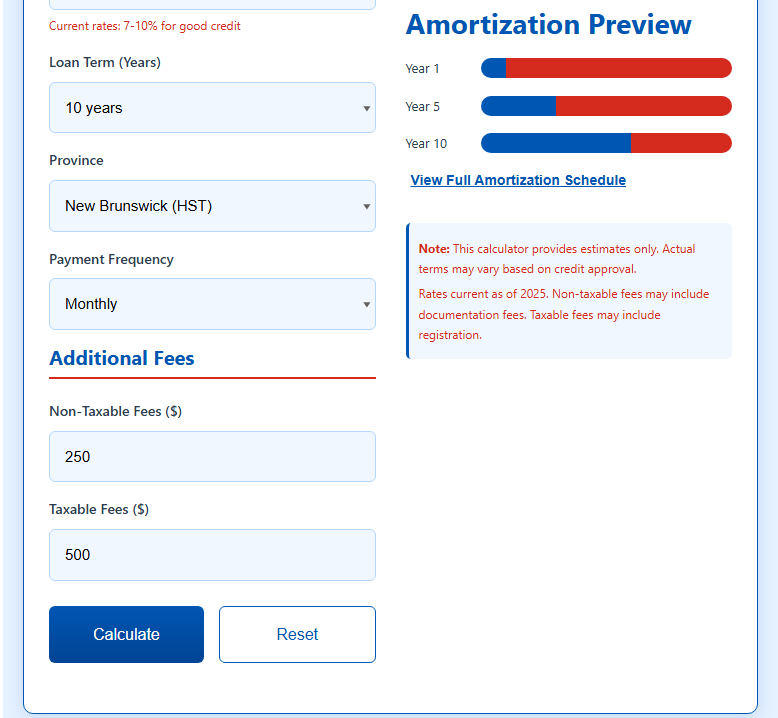

Loan Summary: What You’ll See

Here’s an example of what the results might look like:

- Estimated Monthly Payment: $865.73

- Total Loan Amount: $69,825.00

- Total Interest Paid: $34,062.61

- Total Cost of the Boat: $118,887.61

That’s your all-in figure. It includes everything—the boat price, taxes, fees, and interest. No guesswork. Just facts.

Tax Breakdown

For Canadian buyers, here’s a real bonus: the calculator shows your exact sales tax amounts.

Example:

- HST (15%): $9,075.00

- Total Taxes: $9,075.00

This part makes it crystal clear what taxes are really costing you.

Amortization Table: See How Your Loan Shrinks

Many calculators also show an amortization schedule. This helps you see how each year, more of your payment goes to the principal and less to interest.

Real Talk from Me: Seeing this helped me big time. I started throwing in extra payments here and there—just $100 more now and then. Over the life of the loan? That saved me thousands. Totally worth it.

Pros and Cons of Sailboat Loans

Pros ✅

- You get your boat sooner – No need to wait years to save the full amount.

- Affordable monthly payments – Long terms help keep things manageable.

- Predictable expenses – Fixed rates mean no surprise hikes in payments.

- Paying your boat loan on time can actually boost your credit.

- Possible tax write-offs – In some cases, a sailboat can count as a second home.

Cons ❌

- Interest adds up – Over a long loan, you’ll pay a lot in interest.

- Boats depreciate – Like cars, they lose value over time.

- Extra costs – Insurance, marina fees, repairs, fuel… it all adds up.

- Because this is secured debt, if you don’t make your payments, the lender can take your boat.

- Tougher approval – Lenders might have stricter rules for boat loans.

Frequently Asked Questions (FAQs)

Q1: How long can I finance a sailboat in Canada?

You can finance for anywhere between 5 to 20 years, depending on your credit, the boat’s age, and the lender’s policies.

Q2: Are interest rates for sailboat loans higher than for car loans?

Usually, yes. Boats are generally seen as luxury items, so you’ll often find that their loan rates are a bit higher than what you’d pay for a car.

Q3: What’s the average down payment for a sailboat loan?

Most lenders expect 10% to 20%. The more you put down, the better the deal (and interest rate) you’ll likely get.

Q4: Can I roll taxes and fees into my loan?

Absolutely, in most cases, yes. Just keep in mind, doing so will increase the total amount of your loan and the interest you’ll pay.

Q5: What other costs should I expect with a sailboat?

Insurance, marina/docking fees, regular maintenance, storage, winterization, fuel, and upgrades—all of these are part of ongoing ownership.

Time to Set Sail—The Smart Way ⛵

Owning a sailboat is more than a goal—it’s a dream. But with the right financial tools, that dream doesn’t have to feel out of reach. A Sailboat Loan Calculator gives you the full picture upfront, so you’re not sailing blind.

Go to Easyloancalc.com, plug in your numbers, and see exactly where you stand. Try different loan terms, down payments, and provinces. Adjust the interest rate. See how it all changes.

Once you’ve got a plan that works for you, set your course, raise the sails, and head out on your next great adventure—because the water is calling, and now you’re ready.

Read Detailed Article: Financing For Boats In Canada