Unlock Your Home’s Potential: Understanding the Canadian Reverse Home Loan Calculator 🏡🇨🇦

Hello, Canadian homeowners and financial explorers! Hi friends, Sami here! If you are an experienced homeowner in Canada, chances are you have built up a lot of equity in your home over the years. This equity is a very valuable financial asset — but often it is tied up in the home, making it difficult to use when daily or emergency expenses arise. Have you ever wondered — wouldn’t it be nice to get some money without having to sell your beloved home?

As you age, your financial needs change too. Perhaps you want a little support in your retirement income, or have a health expense, or need some renovations to your home so you can move in and live comfortably, or even help your family. Your home can be your biggest asset, but it often requires selling it to get the money, which many people don’t want to do.

This is where a reverse mortgage comes in. It’s a smart option that allows you to convert your home’s equity into cash — without moving.

I remember my parents discussing their retirement plan. Their home was fully paid off, but sometimes it felt tight for daily expenses. They did not want to sell their home and did not want to be fully dependent on a pension. When the idea of a reverse mortgage came up, it seemed a bit confusing to them at first. It was hard to understand how it worked.

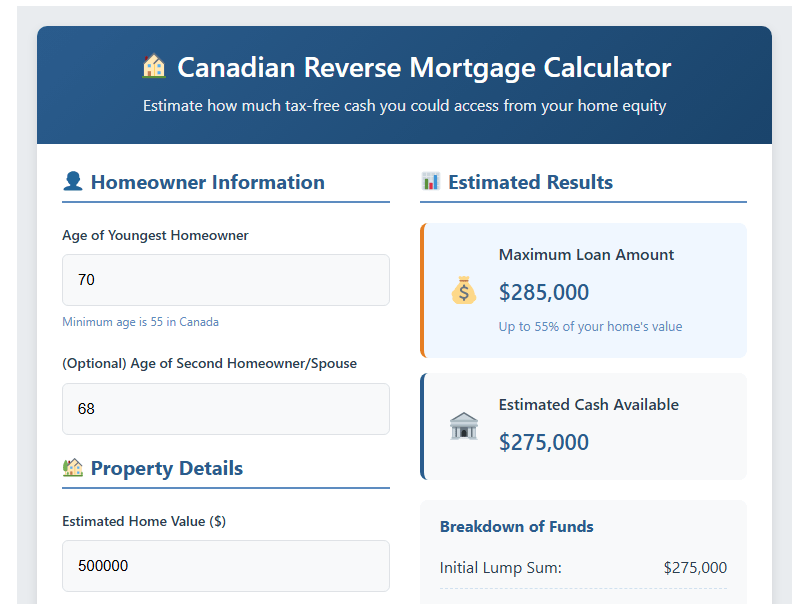

🏠 Canadian Reverse Mortgage Calculator

Estimate how much tax-free cash you could access from your home equity

👤 Homeowner Information

Minimum age is 55 in Canada

🏡 Property Details

💵 Payment Options

📊 Estimated Results

Maximum Loan Amount

$275,000

Up to 55% of your home's value

Estimated Cash Available

$250,000

Breakdown of Funds

Estimated Home Equity Retained

$225,000 (45%)

Loan Details & Considerations

- 📈 Estimated Interest Rate: 5.99%

- 🔄 No Monthly Payments Required while living in the home

- ⏳ Loan Becomes Due: When you sell, move out, or pass away

- 🔑 Home Ownership Retained: You keep the title to your home

- 🛡️ Never Owe More Than Your Home's Value guarantee

- 👨👩👧👦 Impact on Estate: Accumulating interest reduces equity for heirs

Note: These estimates are for informational purposes only. Actual amounts will be determined after a full application and property appraisal.

This is why a tool like the Canadian Reverse Home Loan Calculator is very useful. This tool simplifies the process, showing you clearly how much equity you can convert into tax-free cash. My goal in creating this calculator on Easyloancalc.com was to help you make informed decisions without any confusion.

What Exactly Does a Canadian Reverse Home Loan Calculator Do? 🤔

This special calculator is designed for Canada. It considers some important factors — such as:

- How much maximum loan can you take (tax-free cash)

- How much money will you have in your hands after paying off the mortgage/fees

- How much equity will you have left in your home

- Payment options — lump sum, monthly, or line of credit

- Interest and repayment rules

Your Home Equity Blueprint: Using My Calculator on Easyloancalc.com 🗺️

I have created the calculator in such a way that it is super easy to use — just enter the details and press calculate! Let’s see an example:

Read this Article: Pay Off Home Equity Loan Early Calculator

👤 Homeowner Information: About You

Age of Youngest Homeowner 🧑🦳

The minimum age requirement is 55. The older you are, the more equity you have.

Example: 70

Age of Second Homeowner/Spouse 👩🦳

If your spouse is also a co-owner, their age also counts.

Example: 68

🏡 Property Details: About Your Home

Estimated Home Value ($)

Estimate the market value. There will be a proper appraisal later.

Example: $500,000

Property Type

The type also determines the loan amount.

Example: Detached

Property Location (Province)

The market and lenders can change depending on the province.

Example: Ontario

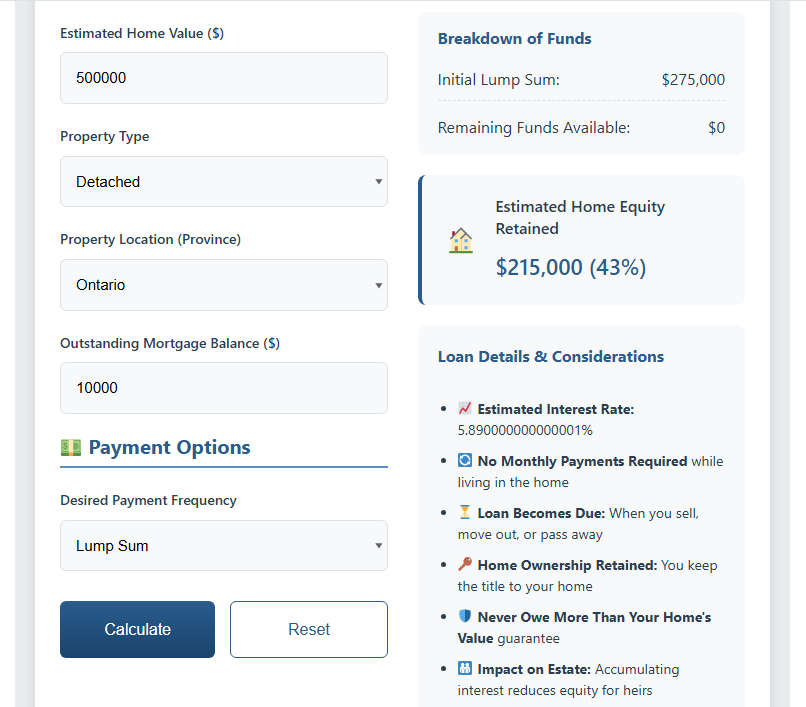

Outstanding Mortgage Balance ($)

Whatever loan is left, it will be paid off with the money from the reverse mortgage.

Example: $10,000

💵 Payment Options: How You Want the Cash

Desired Payment Frequency

How do you want to take cash?

- Lump Sum

- Monthly

- Combination

- Line of Credit

Example: Lump Sum

Initial Lump Sum Amount ($)

Example: $100,000

Click “calculate” and you’re done! You can also reorder for the new scenario.

📊 Estimated Results: Your Financial Picture

The calculator will show you some results like this:

Maximum Loan Amount: $275,000

You can withdraw approximately 55% of the home value.

Estimated Cash Available: $185,000

This is net cash after deducting $10,000 mortgage and some fees.

Breakdown:

- Initial Lump Sum: $100,000

- Remaining Funds: $85,000 (for future use)

Estimated Home Equity Retained: $225,000 (45%)

The home will remain yours – you’re just converting a portion of the equity into cash.

Loan Details & Considerations: Important Information

- Interest Rate: 5.89% (higher than a regular mortgage)

- No Monthly Payments: As long as you live in the home, you don’t have to pay anything.

- When will the loan be paid off? When you sell the house, move out or die.

- Home Ownership: The house remains yours – in your name.

- Never Owe More Guarantee: The loan will never be more than the value of the house.

- Estate Impact: Interest may reduce the equity that heirs will receive.

Sami’s Real-Life Reflection: Why My Parents Considered a Reverse Mortgage 🌟

My parents are very attached to their home. It was difficult for them to even think of leaving the house at the time of retirement. There was a pension, but expenses were increasing. Using the reverse home loan calculator, they understood:

- They can stay at home

- No monthly payment

- You can choose a combo of lump sum + monthly as per your wish

- The “Never owe more” rule was a relief for them

They have not yet taken a loan, but they got the clarity that this option is not a last resort – rather it can be a smart financial tool.

Pros and Cons: Is a Canadian Reverse Home Loan Right for You? ✅❌

👍 Pros:

- No need to sell the house

- No monthly payments

- Tax-free cash

- Use funds anywhere (health, debt, family, travel)

- Never owe more than the home’s value

- You will be the owner of the house

👎 Cons:

- Higher interest rates

- Equity may be less for heirs

- Upfront costs (appraisal, legal, etc.)

- Taxes, insurance and maintenance will have to be paid by you

- Equity is limited (less than HELOC)

- A little complex — it is important to talk to a financial advisor

Frequently Asked Questions About the Canadian Reverse Mortgages Calculator❓

Q1: Who is eligible for a Reverse mortgage?

A: Minimum age 55, and the home should be the primary residence.

Q2: Can I own my home after a reverse mortgage?

A: Yes! You will continue to own your home.

Q3: What happens if I pass away?

A: When the last borrower passes away, the loan is due. The loan is repaid by selling the home, the remaining money goes to the estate.

Q4: Can I make some payments if I want?

A: Yes, voluntary payments are allowed to reduce the interest.

Q5: Will this loan affect my OAS or GIS?

A: No. The money you get from a reverse mortgage is a loan, not income. So government benefits don’t matter.

Empower Your Retirement: Explore Your Home Equity Today! 🌟

If you’re 55+ and want to use your home’s value smartly — without moving — a Canadian reverse mortgage could be a strong option.

Then don’t wait! Visit Easyloancalc.com, use the calculator, and see what options are available for you. Feel empowered with knowledge and fulfill your retirement dreams — in your own home!

Read Detailed Article: Reverse mortgages