Personal Loan Payment Calculator with Additional Payments: Your Path to Financial Freedom

Hey there! Sami here again.

Life throws up a lot of surprises — some are fun, and some are a little tricky. Maybe you’re planning your dream wedding, want to pay off high-interest credit card debt, or need to make a quick home repair that can’t wait. Personal loans can be a big help, but when you think about it, long-term debt can seem a bit overwhelming, right? Have you ever thought you could solve it quickly?

I’ve been there too. When I first took out a personal loan, it was a relief on one hand and a stress on the other that it would last for years on the other. Then I discovered the magic of personal loan calculators—especially ones that show the effects of additional payments. This article and calculator will make you feel like you’re in control. By paying a little extra each month, you can save thousands in interest and become debt-free years sooner.

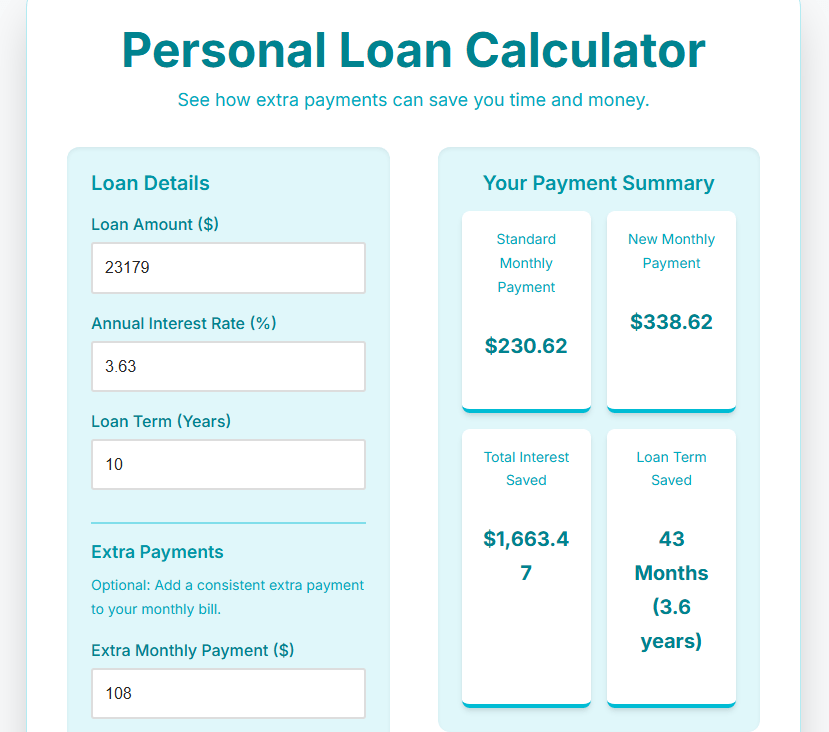

Personal Loan Calculator

See how extra payments can save you time and money.

Loan Details

Why a Personal Loan Payment Calculator with Extra Payments is Your Secret Weapon

A personal loan calculator is not just a fancy tool for a lender; it’s your secret weapon. It gives you a clear view of the entire borrowing scenario:

- See the big picture – you get a true picture of your monthly payment and total interest.

- Use an extra payment calculator to see how quickly you can pay off your debt and how much you’ll save in interest. By trying out different “what-if” scenarios, you can find a payment plan that works for you.

- Plan with confidence – use data to create a repayment plan that’s actionable and motivating.

Read this Article: Personal Loan Repayment Calculator Extra Payments

A simple guide to using your personal loan calculator

We’ve made this tool simple to use. Just enter a few basic details, and it will do the rest.

Loan details

Loan amount ($)

The total amount you’re borrowing. If you’re consolidating debt, this will be the total of all your card balances.

Sami’s tip: Only borrow as much as you need. Every extra dollar attracts interest.

Annual Percentage Rate (%)

The annual charge a lender makes for lending you money.

Sami’s Tip: You should compare different lenders. Because even a 1% difference can save you thousands.

Loan Term (Years)

The time it takes to pay off a loan depends on the loan term, which is the length of time you have to repay the loan. Choosing a longer loan period will make your monthly payments smaller, but it will also increase the total amount of interest you pay by the time the loan is fully paid off. A shorter loan term means higher monthly payments, but you’ll pay less in total interest.

Sami’s Tip: A shorter term is better if you can afford it.

Additional Monthly Payment ($)

Adding even a small amount to your monthly payment can make a huge difference, helping you pay off your loan much faster.

Sami’s Tip: Even an extra $50–$100 can make a big difference.

Summary of Your Payments: The Power of Extra Payments

Let’s look at the example results:

- Standard Monthly Payment: $137.73 – without the extra payment.

- New Monthly Payment: $271.73 – with the extra $134.

- Total interest saved: $2,763.45 – This is how much money will be saved in interest.

- Loan term secured: 81 months (6.8 years) – almost 7 years debt-free!

Sami’s Honest Take: My Personal Loan Story

A few years ago I took out a personal loan for business equipment. The monthly payments were manageable, but I used a calculator and saw that by paying an extra $100 I could not only cover the year but also cut the year into the term. Seeing the results gave me a boost. I stayed consistent and paid off the debt faster.

Pros and Cons of Using a Personal Loan Calculator with Extra Payments

Pros

- Simple and clear explanation

- Shows the direct impact of the extra payment.

- Planning made easy.

- Motivational boost available.

Cons

- Estimates only.

- Fees do not include any hotties (late fees, origination fees, etc.)

Frequently Asked Questions (FAQ)

Is this calculator valid for all Canadian lenders?

Very accurate, but check the lender’s official documents.

Does a personal loan affect my credit score?

There is a slight drop in score when applying, but making timely payments improves the score.

Can I pay off my loan early without incurring a penalty?

Most Canadian lenders allow this, but verification is required.

Final Thoughts and Next Steps

Taking a personal loan is a big step, but it’s manageable with the right tools. Now you know you’re not a passive borrower — you’re in control. Try a calculator, plug in your numbers, and see how much time and money you can save.

Take small, consistent steps. You’ll soon realize – you’ve got it!

Read this Article: Enter your desired payment