Decoding the Jargon: Your Guide to the Loan to Value Calculator

Hey future homeowner or smart investor! Sami here again – and today we are going to break down a financial term that sounds a little complex, but is actually quite simple: Loan to Value (LTV) ratio.

When I was first thinking of buying a home, terms like “LTV” and “equity” literally seemed like a blur. It felt like some secret language of real estate was being used, in which I was an outsider. But when I understood a little, everything became clear. And trust me, a Loan to Value Calculator is the exact tool that made things easy for me – and that’s what I’m going to share with you today.

In this article, I will explain to you in a friendly and straightforward way what is LTV ratio is, how you can calculate it, and most importantly, why it matters for your future and wallet.

Loan to Value Calculator

Loan Information

Summary

What is a Loan to Value (LTV) Calculator?

Imagine you are buying a property. The Loan to Value calculator is a simple tool that instantly tells you how much percent of the total property value you are taking as a loan. In simple words, it compares the loan amount against the asset value.

This tool is helpful for everyone – whether you are buying a house for the first time, planning a remortgage, or taking a business loan in which the asset is secured. This gives you clarity about your financial position – and your risk level in the eyes of the lender.

My Personal “Aha!” Moment

I remember the first time I used the LTV calculator. The price of the property and the amount of my deposit were clear – I input the numbers and the result came – 80% LTV.

At first I did not understand what it meant. Then I found out – this meant I was taking a loan of 80% of the property value and 20% was my own equity. This was a great moment – I realised that my position was strong, and I could qualify for a good mortgage rate. That random percentage suddenly became a confident decision.

Read this Article: Business Loan Calculator UK

How to Use My LTV Calculator: A Step-by-Step Breakdown

Let’s see step-by-step how to use the calculator:

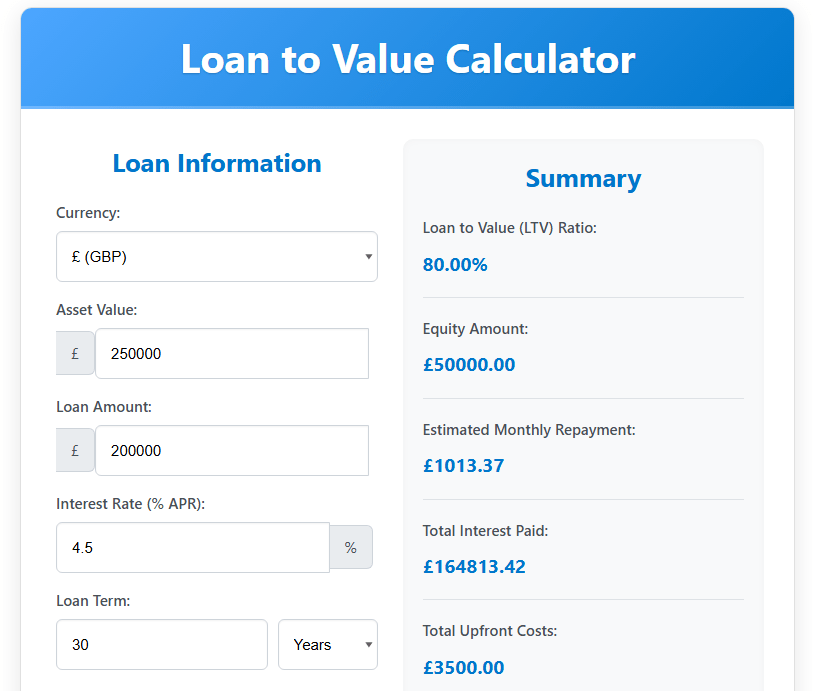

1. Inputting Your Loan Information: The Essentials

Currency: £ (GBP), $ (USD), € (EUR)

Choose the currency according to your location. We will use £ (GBP) here.

Asset Value: £250,000

This is the value of the property you are purchasing or financing – usually the purchase price or official appraisal value.

Loan Amount: £200,000

How much money do you need from the lender – input that here.

Interest Rate (% APR): 4.5%

The interest rate is the percentage you’ll be charged for borrowing the money. A lower LTV (Loan-to-Value) ratio is generally a good thing, as it often helps you secure a lower interest rate.

Loan Term: 30 Years

How many years do you have to repay the loan? longer term means lower monthly payment, but higher total interest.

Payment Frequency: Monthly

Most people pay every month – this is the default and convenient option.

Origination Fee (%): 1%

The lender has a processing fee, which is a certain percentage of the loan.

Other Upfront Costs: £1,500

Add legal fee, property survey, or any one-time purchase expenses here.

2. The Magic Button: 📊 Calculate LTV

After filling in all the details, press the “Calculate LTV” button – and watch the magic happen!

3. Understanding Your Summary: The Insights You Need

Loan to Value (LTV) Ratio: 80.00%

Meaning – you are taking a loan of 80% value of the asset. The remaining 20% is your own money – equity.

Equity Amount: £50,000.00

This is your own contribution – money you invest in property other than the loan.

Estimated Monthly Repayment: £1,013.37

Estimate of the Monthly payment – so you can plan your budget.

Total Interest Paid: £164,813.42

This tells you how much interest you will pay over the full term of the loan. It can be shocking!

Total Upfront Costs: £3,500.00

Total of origination fee and other one-time costs – what you will have to pay at the start.

Total Amount Repayable (Excl. Upfront): £364,813.42

Total of loan + interest – just upfront costs are not included.

Grand Total Cost: £368,313.42

This is the final amount you will pay in total – including everything.

Why Does the LTV Ratio Matter So Much?

The LTV (Loan-to-Value) isn’t just a random number; it’s a key factor that determines your loan’s success, the interest rate you get, and your overall eligibility.

It Determines Your Interest Rate

Golden Rule: Lower LTV = better interest rate.

LTV Bands: Such as 60%, 75%, 90% – lenders offer rates based on these. A lower LTV makes the loan cheaper.

It Affects Your Eligibility

Lenders have a maximum LTV limit. If your LTV is above the limit, it may be difficult to get approval, or you will get a higher rate.

It Reveals Your Equity

LTV directly tells you how much of a stake you have in the property. Lower LTV = more ownership = better financial health.

Pros of a Loan-to-Value Calculator

Pros:

- Clarity: Confusing financial terms are immediately cleared.

- Comparison: Different loan options can be easily compared.

- Empowerment: You can confidently negotiate with lenders.

- Budgeting: You get an estimate of all expenses – upfront and monthly.

Cons:

- Estimates Only: Final LTV is based on the lender’s property valuation.

- No Approval Guarantee: A good LTV is helpful, but income and credit history also matter.

- Does not replace advice: This is a helpful tool – but personal financial advice should also be taken.

Frequently Asked Questions (FAQ)

Q1: What is a “good” LTV ratio?

A: 80% or less LTV is generally best – it gives you a good rate and can also avoid insurance.

Q2: How is LTV different from my “equity”?

A: LTV tells you how much loan you are taking, and equity tells you how much of your own money you have invested.

Q3: How can I improve my LTV ratio?

A: Simple:

- make more deposits

- increase property value (home improvements, etc.)

Q4: Does LTV apply to other loans besides mortgages?

A: Yes, car loans, business loans, home equity loans – wherever an asset is involved, the LTV concept applies.

Conclusion: Own Your Financial Future

Understanding LTV is important not just for taking a loan, but also for making smart decisions. With a simple Loan to Value Calculator you can take control of your future. No more guesswork, no more confusion – just a clear plan.

So use the calculator today, understand your numbers, and confidently take the next step. Whether you’re buying your dream home or investing in property, now you are ready!

Read Detailed Article: Loan to value (LTV) calculator – Which.co.uk