Drive Away with Confidence: Your Guide to the Car Loan Calculator Ireland

Céad Míle Fáilte friends! Sami is here, your digital friend – and today we’re talking about a tool that makes all your car buying planning a breeze. Buying a car is an exciting milestone, but the financing part can be a little confusing. This is especially true in Ireland, where understanding loan terms and numbers can be tricky.

I’ve been through that phase myself – when every car loan offer seemed different and it was all a bit overwhelming. Then I found a game-changing tool: Car Loan Calculator Ireland. It doesn’t just tell you a number – it shows you the whole financial scenario before you make any final decision. In today’s article, I will tell you in a simple and easy way how you can make smarter decisions by using this calculator.

Unpacking the Car Loan Calculator: Your Personal Finance Coach

In simple words, this is a tool that estimates how much money you will have to repay if you take a loan for a car. Just put in a little information and this calculator gives you a clean breakdown – monthly payment, interest, total cost – everything.

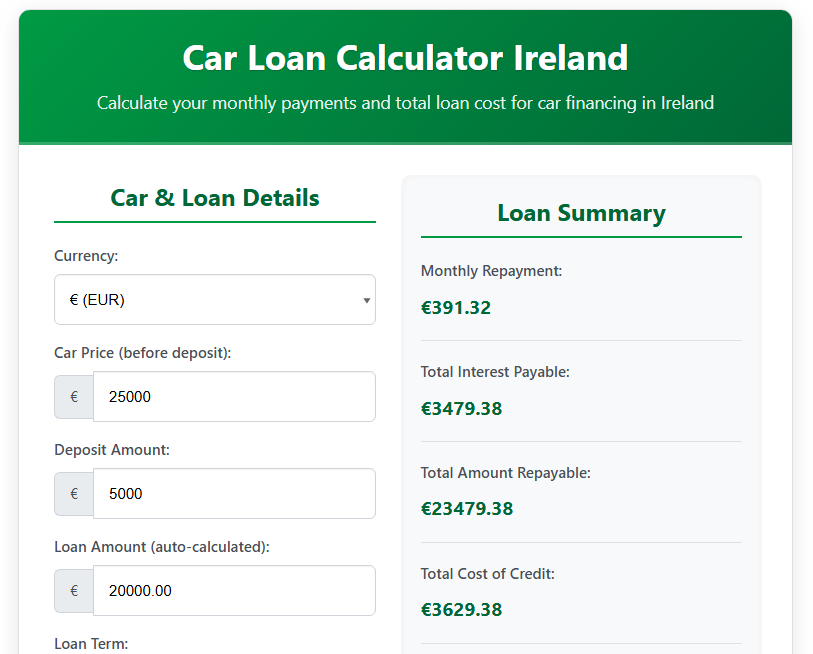

Car Loan Calculator Ireland

Calculate your monthly payments and total loan cost for car financing in Ireland

Car & Loan Details

Additional Costs

Loan Summary

Advanced Summary

If you’re thinking of financing a car in Ireland, this calculator should be your first step. It helps you compare different loans, understand your affordability, and figure out the real cost. It’s a safe bridge from dream car to reality!

My Journey with the Car Loan Calculator

A while ago I needed a new car and had my heart set on a specific model. The price seemed good, but I realised that the on-road price isn’t everything. So I opened up the calculator, plugged in my numbers, and the result opened my eyes.

After looking at the Monthly repayment, total interest, and Total Cost of Ownership, I thought – wait, I will have to think about the budget again. That tool helped me choose a car that I liked and was also in my budget – without any stress.

Read this Article: Car Loan Early Payoff Calculator

How to Use My Car Loan Calculator Ireland: A Step-by-Step Guide

Let’s see step-by-step how to use this calculator. Imagine I am sitting next to you and explaining every step with you.

Car & Loan Details: Laying the Foundation

Currency: € (EUR)

The euro is set automatically, as it is made for Ireland.

Car Price (before deposit): €25,000

This is the full price of your car.

Deposit Amount: €5,000

How much cash are you putting down yourself? The more you deposit, the less you’ll have to borrow.

Loan Amount (auto-calculated): €20,000.00

The calculator automatically gives you this figure—the car price minus your deposit.

Loan Term: 5 Years

For how long are you taking the loan for example 5 years? Short term = high monthly, low interest. A longer-term loan means lower monthly payments, but you’ll pay more in total interest.

Interest Rate (APR): 6.5%

This is the rate that the bank or lender will charge you. The lesser it is, the better.

Car Type: New Car

Car type also affects the rate. New car = generally lower risk = better rate.

Additional Costs: Seeing the Full Picture

Arrangement Fee: €150

There is a one-time fee for loan setup; don’t ignore it.

Annual Insurance: €800

In Ireland, insurance isn’t just a good idea—it’s the law. It’s also a major expense you need to factor into your budget.

Annual Road Tax: €200

This is also a yearly expense – it depends on engine size and emissions.

The Magic Button: 📊 Calculate

After entering everything, you will get the full result in just one click!

Understanding Your Loan Summary

Monthly Repayment: €391.32

This is the most important number – you will have to keep this much money ready every month.

Total Interest Payable: €3,479.38

Over the entire loan term, this is the total amount of extra interest you will pay.

Total Amount Repayable: €23,479.38

This will be the total amount of the loan, plus the interest.

Total Cost of Credit: €3,629.38

This is the actual loan cost, including interest and fees.

Seeing the Advanced Summary: The Total Cost of Ownership

Total Cost of Ownership (over loan term): €28,479.38

This is the final figure – car price + loan cost + insurance + road tax – after all this is the real commitment.

Benefits of Using a Car Loan Calculator Ireland

Clarity and Financial Confidence

No More Surprises

Everything will be clear from the beginning – there are no hidden charges.

Informed Decisions

You will make decisions based on data, not emotions.

Negotiating Power

You will know how much you can afford – you will feel strong in the dealership.

Comparing and Finding the Best Deal

Shop Around

Banks, credit unions, and dealerships compare everything.

Finding the Sweet Spot

You can find the perfect balance between monthly payment and total cost.

Responsible Budgeting

Live Within Your Means

You will know if the car you want fits in your budget.

Holistic View

Insurance and tax are also counted – it shows the full picture.

Pros and Cons of a Car Loan Calculator

Pros:

✔ An instant, free estimate is available

✔ Gives you control

✔ Shows the full cost apart from the loan

✔ Easy to compare different options

Cons:

✖ Only an estimate is available – the final offer can be different

✖ This doesn’t cover all the costs, such as fuel and maintenance.

✖ You can only see one scenario at a time.

Frequently Asked Questions (FAQ)

Q1: What is the difference between a car loan and PCP in Ireland?

The calculator only lets you see one scenario at a time. In PCP you make a deposit + monthly payment and a big final payment at the end if you want to keep the car. The calculator is mostly better for traditional car loans.

Q2: What interest rate should I expect in Ireland?

The interest rate depends on your credit history and car model. Normally 6% to 9% APR is offered. Check with different lenders.

Q3: What is “Total Cost of Credit”?

This is the extra amount you will pay on top of the principal interest + fees. This tells you the real cost of the loan.

Q4: Should I get a fixed or variable interest rate?

In a fixed rate the payment is the same every month – budgeting is easy. In a variable the amount will keep changing. Most people prefer a fixed rate for peace of mind.

Conclusion: Take the Driver’s Seat of Your Finances

Buying a car in Ireland is a big financial decision. But if you use the right tools – like this Car Loan Calculator Ireland – then everything becomes easy. You get full clarity, confidence, and are able to make the best decision.

My advice: Use the calculator before going to the dealership. Find out what is a realistic budget and what will be the total cost. This simple step will make you the true driver of your finances.

Ready to start your journey? Use the calculator and become a smart car buyer!

Detailed Article: Best Loans in Ireland | Low Rate Loans