The Personal Loan Repayment Calculator 📈

Hello financial navigators!

Sami is here – your money guide – and if you are planning for a new project, or want to manage multiple loans together, or have an emergency expense, then a personal loan will definitely come to mind. It is very useful when you need money urgently. But, like every loan, it has to be repaid – and that is also a responsibility.

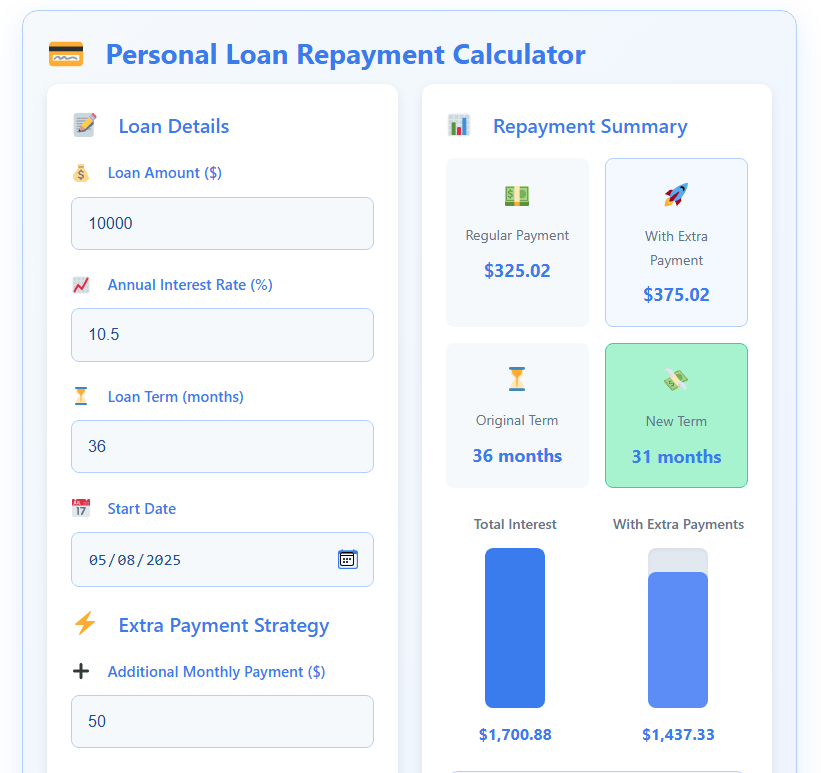

💳 Personal Loan Repayment Calculator

📝 Loan Details

⚡ Extra Payment Strategy

📊 Repayment Summary

🧾 Payment Breakdown

💡 Smart Repayment Tips

- Pay biweekly: Split your monthly payment in two and pay every two weeks (26 payments/year)

- Round up payments: Adding even $20-50 extra each month makes a significant difference

- Use windfalls: Apply tax refunds, bonuses, or other unexpected income to your principal

- Check for penalties: Confirm your lender doesn't charge prepayment penalties

Mastering Your Money: The Personal Loan Repayment Calculator 📈

When you take a personal loan, you initially get a relief – because you get the money immediately. But then the following thoughts come to mind: How long will the monthly payment be? How much will I have to pay tomorrow? Can I pay off the loan early? Is there any way I can avoid interest?

I remember when I took a personal loan, I thought it was manageable after looking at the lump sum amount – but when I started calculating its long-term effect, I got confused. Financial terms, interest, amortization – everything seems quite complicated.

That is why a smart and easy-to-use tool like Personal Loan Repayment Calculator comes in handy. This gives you a clear picture of how to manage the loan, and how you can repay it quickly and save money.

What Exactly Does a Personal Loan Repayment Calculator Do? 🤔

This calculator is specially designed so that you can understand your personal loan repayment plan and make smart decisions:

- Standard monthly payment: If you go on the basic plan, how much will you have to pay every month

- Effect of extra payment: If you pay a little extra, what difference will it make

- New loan term: How many months can you save by paying early

- Interest savings: How much money will be saved in interest

- Total loan cost: Complete breakdown of Principal + interest

- Payment allocation: How much of each of your payments goes to principal and how much goes to interest.

Read this Article: Early Payoff Calculator Personal Loan

Your Path to Debt Freedom: Using the Personal Loan Repayment Calculator on Easyloancalc.com 🧭

I have this calculator on Easyloancalc.com We have created it in such a way that anyone can use it – without stress, just have to enter some basic details, and you get full repayment insight.

Let’s take a basic example:

Loan Details: Your Personal Loan Snapshot 📝

Loan Amount ($) 💰

The amount you have borrowed or are going to borrow.

Example: $10,000

Annual Interest Rate (%) 📈

The yearly interest or APR of your loan.

Example: 5.5%

Loan Term (months) ⏳

How many months has the loan been taken for? Usually it is between 12–60 months.

Example: 36 months

Start Date 📅

When your loan payment starts or will start.

Example: July 2025

Extra Payment Strategy: Accelerating Your Payoff! ⚡

Here you can see how much time and interest you can save by putting a little extra money.

Additional Monthly Payment ($) ➕

How much extra can you afford every month? This goes directly to the principal.

Example: $50

One-Time Payment ($) 🎁

If you get any bonus or extra money, then you can also see the impact by putting a big payment once.

Example: $0 (but you must try if you get something extra!)

Then click on “Calculate” and see the results. You can also try a new scenario by “Reset“.

Repayment Summary: Your Future in Focus! 📊

If your loan is $10,000, 5.5% interest, 36 months, and you pay $50 extra every month, then this is the result:

Regular Payment: $325.02

Your normal monthly EMI

With Extra Payment: $375.02

When you pay $50 extra ($325.02 + $50)

Original Term: 36 months

New Term: 31 months

You finished the loan 5 months early – amazing!

Total Interest: $1,700.88 (if you make only regular payments)

With Extra Payments: $1,437.33

Interest Savings: $263.55

You have saved so much money!

Total Cost of Loan: $11,437.33

Payment Breakdown: Understanding Your Contribution 📊

It also shows how your money is being divided between principal and interest:

Principal: $10,000

Interest: $1,437.33

Total Payments: $11,437.33

Sami’s Real Story: Conquering My Personal Loan 🌟

A few years ago, I took a personal loan to consolidate my small loans – the interest was low, and a single payment made it easy. But still, I thought about how to finish the loan quickly.

I opened the calculator on Easyloancalc.com. It was a $15,000 loan, decent rate. Then I thought, “What if I add an extra $75 every month?”

Result? The loan finished 8 months earlier and I saved more than $400 in interest!

That year, I got a bonus, and I put a large part of it into the loan. The calculator showed that even more interest was saved.

And when the last payment was made, I felt a different level of freedom – as if a burden had been removed. This calculator empowered me to take financial control.

The Big Benefits of Using a Personal Loan Repayment Calculator 💡

This is not just a calculator; it is a financial strategy tool:

Maximize Your Savings on Interest 💰

- Interest saving is clearly shown

- Loan cost is reduced by paying the principal early

Achieve Debt Freedom Sooner 🏁

- The exact new payoff date is received

- Your monthly income will be freed soon

Informed Financial Decision-Making 🧠

- You can try different scenarios

- The full cost of the loan is understood

Reduce Financial Stress and Gain Confidence 💖

- Having a clear plan reduces stress

- You get the confidence of financial control

Pros and Cons: Should You Pay Off Your Personal Loan Early? ✅❌

Pros of Early Payoff 👍

- Heavy savings in interest

- Debt-free life is achieved quickly

- Better DTI ratio

- Stress-free life

- Flexibility in the monthly budget

Cons of Early Payoff 👎

- Sometimes there is a prepayment penalty (do check)

- Do not empty the emergency fund

- Investment opportunities may be missed

- Credit mix may have a slight impact

Frequently Asked Questions About Personal Loan Repayment ❓

Q1: Does the extra payment go to the principal or the interest?

Usually it goes to the principal, but while making an online payment, check the option of “Apply to principal”.

Q2: Is a personal loan better or a credit card for big expenses?

Generally, a personal loan is better because the interest is lower and the repayment period is fixed.

Q3: Should I pay early even if the interest rate is low?

If there is no other high-interest loan, emergency fund is strong, then yes. Otherwise, you can also invest that money – it depends on your financial goals.

Q4: Does early repayment improve credit score?

Yes, because your debt is reducing. There may be a slight dip due to account closure, but overall it’s good for your score.

Your Financial Power: Calculate Your Way to Personal Loan Freedom Today! 🔑

Now take control of your loan – not just to save interest, but to fast-track your financial journey. Visit Easyloancalc.com, use the calculator, and see how quickly you can become debt-free.

Then think – when the loan is over, what goal will you use that extra money for?

More Info: Personal loan repayment calculator extra payments