Business Loan Calculator Canada: Your Guide to Better Borrowing

Hey guys! If you’re reading this, you’re probably an aspiring business owner in Canada like me. You have big dreams—maybe buying a new machine, opening a new store, or finally hiring your first employee. But with those dreams comes a big question: “How do I manage the money?”

This is where the topic of business loans comes in, and honestly, it can be quite confusing. The interest rates, the terms, the monthly payments… everything is mind-boggling. I remember many sleepless nights when I was looking for my first business loan. It was like a sea of numbers and I was lost in it.

That’s why I created Business Loan Calculator Canada. It’s not just a tool, it’s a way to give you the clarity, control, and confidence to make the right financial decisions for your business. Think of this article as a friendly walkthrough—I, Sami, will guide you step-by-step on how you can plan your debt and save thousands of dollars.

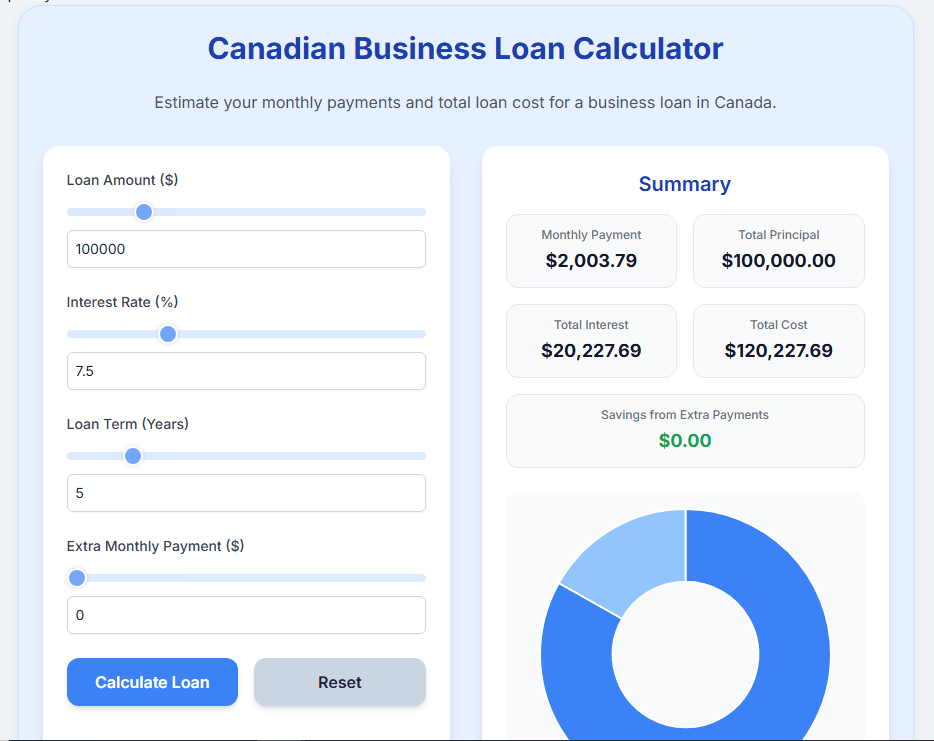

Canadian Business Loan Calculator

Estimate your monthly payments and total loan cost for a business loan in Canada.

Summary

Why a Business Loan Calculator is Your Best Friend

You need a solid plan before you talk to a bank or lender. A business loan calculator works like a digital secret weapon. It not only tells you your monthly payment, but also gives you a clear picture. You can change the interest rate or loan term to see how the total cost is affected.

I personally use this tool for every financial decision I make. It gives me confidence that I’m not guessing. With this tool, you’ll have the knowledge you need to make confident, informed decisions. It gives you the power to take control of your finances.

Read this Article: Business Loan Calculator UK

How to Use a Business Loan Calculator Canada (A Simple Guide)

I’ve made this calculator as simple as I would explain it to a friend over coffee. Just fill in the 4 fields, and press “Calculate”. Don’t worry if the numbers are wrong, just change them and try again.

Loan Amount ($)

This is the total capital needed for your business. Example: $100,000.

💡 Sami’s Tip: Only borrow as much as you need. Extra money is tempting, but every dollar comes with interest.

Interest Rate (%)

This is the annual interest rate you’re expecting. Example: 7.5%.

💡 Sami’s Tip: Compare rates from different lenders. A small difference now can add up to huge savings over the long term.

Loan Term (Years)

This is the period over which you’ll repay the loan. Example: 5 years.

💡 Sami’s Tip: A shorter loan term means higher monthly payments and less total interest. A longer term will lower your monthly payments, but you’ll pay more interest over the life of the loan.

Additional Monthly Payment ($)

This is my favorite field. You can add additional payments and see how you can close the loan faster. Example: $4,050.

💡 Sami’s tip: Even a small additional payment can make a big difference in the long run.

The magic of the “Calculate Loan” button

Fill in all the fields and press “Calculate Loan“, and you’ll get a clear breakdown right away.

Understanding your results: A quick summary

Example: $100,000 loan, 7.5% rate, 5 years, $4,050 extra per month.

- Monthly Payment: $2,003.79 (Basic payment, with the extra, you will earn more but close faster)

- Total Principal: $100,000 (the loan amount will remain constant)

- Total Interest: $5,876.83 (the actual cost of borrowing)

- Total Cost: $105,876.83 (principal + interest)

- Savings from the extra payments: $14,350.86 (you can save this money and invest it in a business or vacation)

Sami’s Personal Insight: Why I Love This Tool.

When I started my digital creative agency, I needed a loan for cameras and software. Using the calculator, I found that by making a small extra monthly payment, I could pay off the loan a year early. It doesn’t just give you a number; it gives you a strategy. Now I use this tool for every major financial planning project.

Advantages and Disadvantages of Using a Loan Calculator

✅ Pros

- Explains.

- Budget planning becomes easier.

- Shows the impact of additional payments.

- Best way to compare loan offers

⚠️ Cons

- An estimate only

- Fees not included (such as origination fees)

Frequently Asked Questions (FAQ)

Is this calculator valid for all banks in Canada?

Yes, the calculator uses a standard formula to work out loans. But keep in mind that your final numbers will depend on the specific terms your lender offers.

What is amortization?

Simply put, amortization is the process of paying off a loan with equal, regular payments. In the beginning, a larger part of each payment goes toward the interest. As time goes on, a larger portion goes toward paying down the actual loan amount, or principal.

Can I use it for a mortgage?

Similar math, but mortgage rules are different in Canada.

Final thoughts and next steps

Taking a business loan is a big commitment, but there’s no need to be afraid. With knowledge, you can make the best use of this tool to grow your business. Now run the numbers for your business, use the calculator, and see how a small extra payment can make a big difference for you.

Detailed Article: Business loan calculator and amortization schedule