Government Business Loans Ireland – Funding Your Entrepreneurial Dreams

Hey there, fellow entrepreneur!

Sami here, your go-to digital creator – and today we’re going to talk about a topic that could be a game-changer for your business – Government Business Loans in Ireland 🇮🇪.

You see, when you have a brilliant business idea or a growing company, but lack funding, frustration is obvious. The traditional banking system can be a little tough – especially for startups or microenterprises. That’s why I wanted to tell you about the government support systems specifically designed for small businesses.

These aren’t free handouts – they’re strategic and affordable loans and grants aimed at making your business successful.

Government Business Loans Ireland

Calculate your potential government-backed business loan repayments

Business Information

Loan Details

Additional Options

Loan Summary

Loan Details

Available Government Schemes

What are Government Business Loans in Ireland?

In simple words these loans are the financial support that the Irish government directly or indirectly provides to small businesses and startups. And their main goal is to help businesses that find it difficult to get a traditional bank loan.

Government-backed agencies such as Microfinance Ireland and Local Enterprise Offices (LEOs) manage these schemes. They provide not just money, but mentorship and training as well – so it’s a full support package.

Read this Article: Mortgage Repayments Calculator Ireland

My “Aha!” Moment with Government Support

When I was starting my business, I too used to feel that growth was impossible without funding. The bank clearly said “No collateral, no loan.” Then a mentor said, “Sami, try government-backed options.” I was a little skeptical at first, but when I explored LEO resources I realized that this system is specially made for businesses like mine.

It wasn’t about free money. It was about getting the right tools to build something long-term. And honestly, my business journey totally changed from that day.

How to Use My Government Business Loans Calculator

Let us now understand through the calculator how you get a realistic idea of taking a loan:

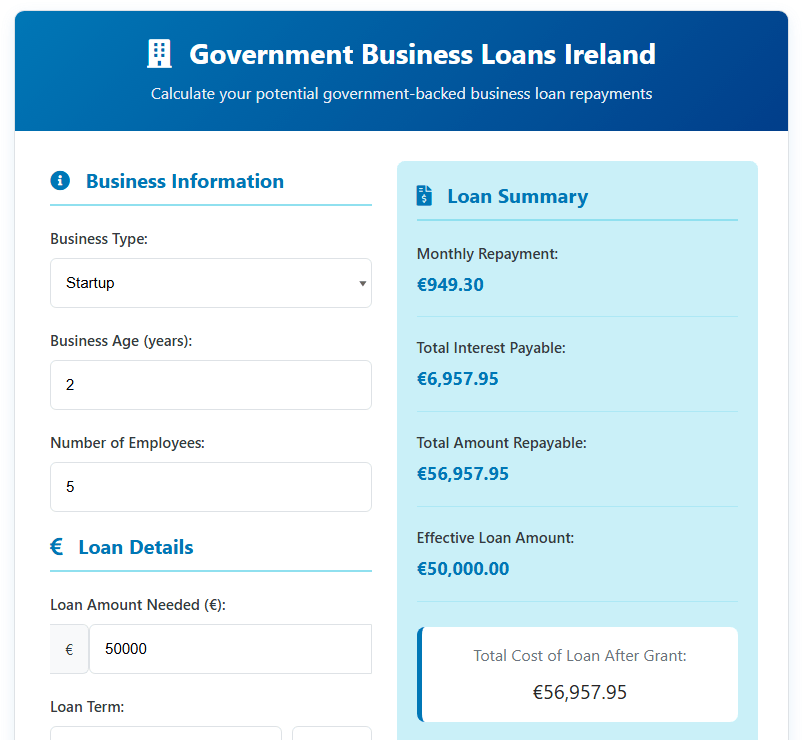

1. Business Information: Your Details

Business Type: Startup

It is important to tell whether your business is new or old. Different support schemes are available for startups.

Business Age (years): 2

The age of your business matters – some grants are only for businesses younger than 18 months.

Number of Employees: 5

Microenterprises are those that have 10 or fewer employees. Most government loans are for them.

2. Loan Details: Defining Your Need

Loan Amount Needed (€): €50,000

How much money do you need? Put it here. Different schemes have different limits.

Loan Term: 5 Years

How long do you have to repay the loan – set this. Government loans usually offer flexible terms.

Interest Type: Fixed Rate

Fixed rate is a safe option – same EMI every month, no surprises.

Interest Rate (%): 5.25%

This rate is generally much better than banks – especially for startups.

3. Additional Options: Adding Flexibility

Eligible for Government Grant? No

A grant and a loan are different things. You can take a grant for a specific project, and a loan for working capital. Both are possible together.

Repayment Holiday (months): 0

You can pay only interest or nothing for the first few months – this is a repayment holiday. This feature can be a real game-changer, especially for startups. We’ve set the value to zero for now, but you can enter your own data to see how it affects your results.

4. The Magic Button: Calculate Loan & Reset

After all the data is filled, just press the “Calculate” button – and the calculator shows you a clear picture. If you want to reset, the option is also available.

5. Loan Summary & Details: Your Financial Roadmap

Monthly Repayment: €949.30

How much money will you have to repay every month – this is your EMI figure. Super important for cash flow planning.

Total Interest Payable: €6,957.95

How much extra interest you will pay in full in 5 years – this number tells you.

Total Amount Repayable: €56,957.95

Loan amount + interest – this is the total amount you will repay.

Effective Loan Amount: €50,000.00

This is the money you will get in your hands – the actual usable capital.

Available Government Schemes

The calculator tells you which government schemes may suit your business, such as the Microenterprise Loan Fund or LEO grants.

Why Should You Consider Government Business Loans in Ireland?

Favorable Terms & Lower Interest Rates

- Affordable Borrowing: These loans are cheaper than commercial banks.

- Flexible Options: Repayment holidays, mentoring – everything comes with proper support.

Access to Finance for All

- Banks: Have You Considered It? No Worries: These loans are specially for those businesses that have been rejected by banks.

- Broad Eligibility: Sole trader, partnership, or limited company – everyone can apply.

Additional Support & Mentoring

- More Than Money: LEOs and other bodies also provide you with mentoring, networking and training. Sometimes, the support you receive is more valuable than the money itself.

Pros and Cons of Government Loans

Pros:

- Lower Interest Rates

- More Approval Chances (especially if the bank agrees)

- Mentoring & Business Advice included

- Fixed interest = peace of mind for monthly budgeting

Cons:

- Application Process is a little detailed

- There are some eligibility rules (business size, age, etc.)

- Loan limit is fixed – may not be enough for large businesses

Frequently Asked Questions (FAQ) About Irish Government Business Loans

Q1: What is Microfinance Ireland?

A: It is a non-profit lender supported by the Irish government. They provide unsecured loans of up to €50,000 to businesses that cannot get a loan from a bank.

Q2: What is the Local Enterprise Office (LEO)?

A: LEOs are present in every county in Ireland – they help small businesses through funding, advice, and training.

Q3: What is the difference between a loan and a grant?

A: The key difference is that loans must be paid back with interest, while grants are a form of free funding. The catch is that grants are usually for specific projects and are highly competitive.

Q4: Can I get a government loan even if a bank has refused me?

A: Absolutely! Microfinance Ireland’s main job is to provide funds to businesses that have been refused by banks but are viable.

Conclusion: Fund Your Vision, Build Your Future

Look friend, getting funding can be tough – but there are tools and schemes available in Ireland that are specially designed for business owners like you.

The Government Business Loans Ireland calculator is an easy and practical first step. It shows you that your idea is not just a dream – it can become a fully fundable, realistic plan.

So put fear aside, explore the options, and confidently fund your vision. The Irish government wants you to succeed – and now the ball is in your court.

Ready to move forward? Contact your local LEO, discuss your idea, and apply for the best-fit loan or grant!

Read the Govt Website: Government Business Loans