Mortgage Repayments Calculator Ireland – Your Home Buying Guide

Hello, homeowners!

I’m Sami, your friendly digital creator. Today we’re going to talk about a crucial topic in the home buying process in Ireland: mortgage payments. 🏡

We all dream of owning a home, right? But when it comes to the numbers and payments, everything can get a little confusing. To clear up all that confusion comes a super helpful tool – Mortgage Repayments Calculator Ireland. This calculator clears up your financial doubts and gives a crystal clear picture of what you can afford.

I’ve been through this process myself, and do you know? It was all overwhelming at the start – so many numbers, terms and decisions. But my “aha!” moment came when I realised that if I could understand my monthly repayment, the whole process would be much simpler. Then I used this calculator – and honestly, it became my secret weapon!

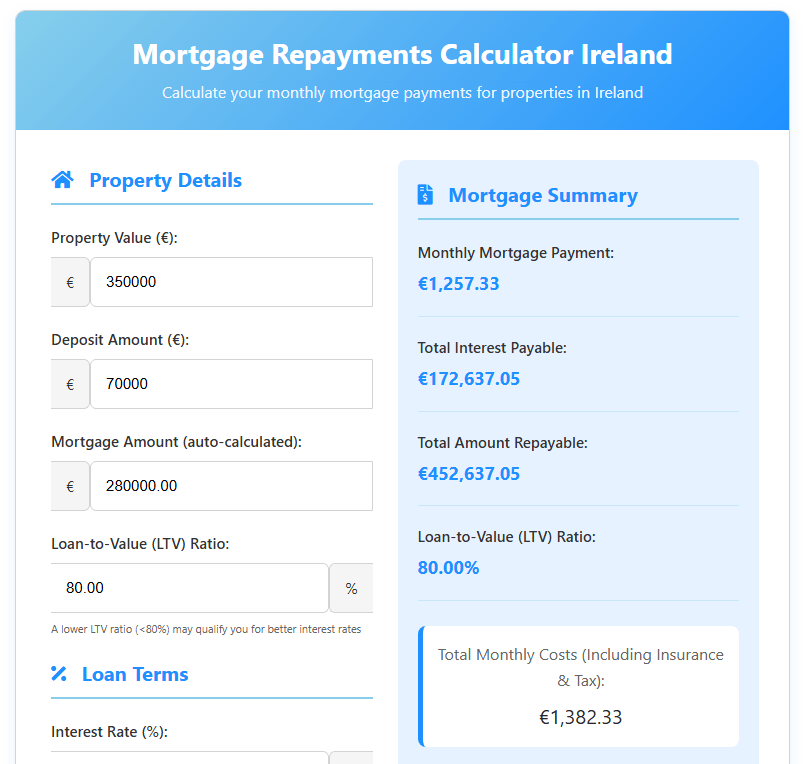

Mortgage Repayments Calculator Ireland

Calculate your monthly mortgage payments for properties in Ireland

Property Details

Loan Terms

Additional Costs

Mortgage Summary

Advanced Summary

What is a Mortgage Repayments Calculator Ireland?

In simple terms, this calculator is an online tool that estimates what your monthly mortgage payment would be. All you need to do is input the loan amount, interest rate and term (duration).

If you are planning to buy a property in Ireland, this calculator is a must-have. Why?

- Gets a fair idea of budget: How much money you will have to spend every month – this becomes clear.

- You can compare different options: Try different interest rates or terms and see which option makes repayment easier.

- Helpful for future planning: Not just the home price, but the total cost of actual ownership is known.

Basically, it turns uncertainty into confidence!

My Personal Experience: From Guesswork to Control

I remember when I sat down to calculate my affordability. I had a rough idea of what property prices were going to be, but the monthly mortgage payment was an abstract concept. Then I dug out a calculator and started plugging in the numbers.

As soon as I changed the interest rate or loan term a little, the monthly repayment and total interest changed drastically – and that was a shocker! Then I understood how much money a little difference in rate can save in the long term.

This tool gave me control – and I want you to get the same feeling.

Read this Article: Car Loan Calculator Ireland

How to Use My Mortgage Repayments Calculator Ireland

Let’s see step-by-step how to use this tool:

1. Property Details: Setting the Scene

Property Value (€): €350,000

You have to input the total value of the house on which you are taking an interest.

Deposit Amount (€): €70,000

This is the money you are paying up front. According to Central Bank rules in Ireland, first-time buyers have to pay at least a 10% deposit. More deposits = less loans + better rate chances!

Mortgage Amount (auto-calculated): €280,000.00

This calculator will automatically calculate: Property Price – Deposit = Mortgage Amount.

Loan-to-Value (LTV) Ratio: 80.00%

This is also calculated automatically. For example, in this case, a 280k loan on a 350k property = 80% LTV.A lower LTV ratio often helps you secure a lower interest rate.

2. Loan Terms: Defining the Deal

Interest Rate (%): 3.5%

Your lender will charge you this rate. Even a small rate difference can have a huge impact in the long term.

Mortgage Term: 30 Years

The length of your loan is entirely up to you. While 20, 25, or 30 years are common terms, it’s important to understand the trade-off.

3. Additional Costs: The Full Picture of Homeownership

Annual Home Insurance (€): €500

Protects the home from damage, and the lender mostly makes this mandatory.

Annual Life Insurance (€): €600

It is called Mortgage protection insurance – if something happens to you or the co-borrower, the loan is repaid.

Annual Property Tax (€): €400

In Ireland, it is called Local Property Tax (LPT) – this has to be paid annually to the local authority.

4. The Magic Button: Calculate & Reset

Now everything is filled? Just press “Calculate“. And if you want to try a new scenario then press “Reset“.

5. Mortgage Summary: Your Financial Snapshot

Monthly Mortgage Payment: €1,257.33

This is the main number – how much money you have to repay every month. This includes principal + interest.

Total Interest Payable: €172,637.05

How much interest will you pay over the entire 30 years – that’s the real cost of borrowing!

Total Amount Repayable: €452,637.05

Total loan + interest. By the time you make your last payment, you will have owed the bank this much money.

Loan-to-Value (LTV) Ratio: 80.00%

This reminds you how much percentage of your assets you are financing – and how much equity you have.

Total Monthly Costs (Including Insurance & Tax): €1,382.33

Your total monthly expense includes your mortgage, insurance, and Local Property Tax (LPT). This combined figure is essential for creating a realistic budget.

6. Payment Breakdown & Advanced Summary

Some calculators also give a breakdown – they show how much of the principal and interest is in each payment. In the Advanced summary, all your input data is reconfirmed.

Why Use a Mortgage Repayments Calculator Ireland?

Empowering Your Budget and Financial Planning

- Real-World Affordability: Shows the actual impact of all extra costs – not just the home price.

- Stress Reduction: When you know everything up front, there is no stress.

- Strategic Deposit Planning: You can try different deposit amounts to see which will work best.

Optimising Your Loan Terms

- Interest Rate Impact: Even a 0.1% rate change can save a lot of money!

- Term vs. Payment Comparison: 25 vs. 30 years difference is easily understood.

- LTV Advantage: Better deposit = lower LTV = better rate prospects.

Pros and Cons of a Mortgage Repayments Calculator

Pros:

- Instant results

- Free and easy to use

- Can compare different loan options

- Option to include extra costs

Cons:

- It only gives an estimate – the final offer will depend on your credit, income, and lender policy

- One-time charges such as legal fees, stamp duty are usually not included

- Is static – does not account for future interest rate changes

Frequently Asked Questions (FAQ) About Mortgages in Ireland

Q1: What’s the typical deposit for a mortgage in Ireland?

A: First-time buyers have to pay a minimum 10% deposit. For buy-to-let properties, it can be up to around 30%.

Q2: What’s the difference between fixed and variable interest rates in Ireland?

A: Fixed rate = same monthly payment for certain years (e.g., 5 years).

Variable rate = can change at any time, depending on market conditions.

Q3: Is mortgage protection insurance compulsory in Ireland?

A: Yes, it is mostly mandatory. If the amount is reduced, the loan repayment is covered.

Q4: Besides the mortgage payment, what other costs should I budget for?

A:

- deposit

- Stamp Duty

- Legal Fees

- Valuation Fee

- Survey Fee

- Home Insurance

- Life Insurance

- Local Property Tax

- BER Certificate

Conclusion: Take Control of Your Irish Mortgage Journey

Buying a house is a big step – and even bigger in Ireland. But if you have a proper idea of mortgage repayment, then this step becomes exciting, not stressful.

Mortgage Repayments Calculator Ireland is a powerful tool that gives you clarity, control and confidence. Play with numbers, imagine the future, and make smart financial decisions.

Try it today – start planning your dream home. You’ve got this! 💪

Read Detailed Article: Mortgage Repayment Calculator