Boat Loan Calculator: Chart Your Course to Confident Boat Ownership in Canada!

Hi friends, water lovers and future captains! Same this side. If you’re like me, the call of the open water is hard to ignore. Whether it’s the thrill of the speed of a powerboat, the peace of an early morning fishing trip, or a lazy cruise with friends and family there’s something else altogether that makes your own boat fun.

But tell the truth, as exciting as it is to own a boat, an equal number of questions pop up in your mind – “How will I manage these expenses?” When I was thinking of buying my first boat (yes, a small fishing boat!), I had a hard time understanding the financial part. Loan terms, interest rate, down payment and Canadian taxes like GST, HST, PST – all seemed a bit confusing.

That’s why the Boat Loan Calculator is a must-have tool. It shows you the proper numbers to make your dream a reality. No guesswork – just clarity. Now let me tell you step by step how this calculator works and how it prepares you for boat ownership that too as per Canada!

Boat Loan Calculator

Select Region Boat Loan

Loan Summary

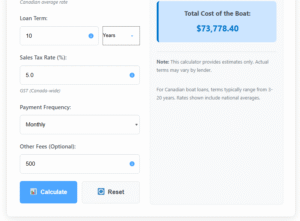

Note: This calculator provides estimates only. Actual terms may vary by lender.

What is a Boat Loan Calculator, and Why Does It Matter for Canadians?

Look friend, if you understand in simple language then the Boat Loan Calculator is a kind of financial GPS. It gives you an estimate of your monthly boat payment and also tells you the actual total cost of the boat when buying a boat on loan.

And if you are in Canada, the tax system is also quite unique – so this calculator considers that too. So, you get a clear picture without any stress.

Why You Need This Calculator:

- Clarity of Monthly Payments: You will know beforehand how much money you will have to pay every month or week.

- Get an idea of the true cost (Total Interest): It shows not only the loan amount but also the interest amount you will have to pay. Many people underestimate this part.

- Total Financial Picture: It doesn’t just focus on the price of the boat – it includes taxes and fees.

- Benefits of Down Payment and Trade-in: If you pay some amount upfront or trade in an old vehicle, the loan burden is reduced.

- Accurate according to Canada Tax System: Get accurate calculations of GST, PST, HST – everything.

The end goal is that when you buy a boat, it becomes a reason for happiness – not a cause for worry.

Read this Article: Business Loan Calculator UK

Charting Your Course: How to Use the Boat Loan Calculator

I’ve made the Boat Loan Calculator simple, user-friendly and powerful. You just enter the details step by step, and this calculator will tell you if your plan is financially fit or not.

Boat Loan Details: Your Vessel’s Vital Stats

Select Region Boat Loan: Boat Loan Calculator Canada

First of all, you must select Canada. Then the calculator will calculate your province’s taxes, so that the figures are accurate.

Boat Purchase Price (Before Tax): ($)

This is the price that is written on the sticker of the boat – without taxes. Be sure to confirm this with the seller or dealer.

Example: $50,000

Down Payment / Rebates: ($)

How much money are you paying upfront or getting any rebate – that is to be entered here. Paying a higher down payment reduces both the loan amount and interest.

Example: $10,000

Trade-in Allowance: ($)

If you are exchanging an old boat, RV or vehicle, then its value has to be written here. This amount is directly subtracted from your loan amount.

Example: $5,000

Amount Owed on Trade: ($)

If there is any loan outstanding on the trade-in vehicle, then that amount is also necessary to be written here. This is subtracted from the trade-in allowance.

Example: $2,000

Loan Terms: The Financial Engine of Your Purchase

Interest Rate (% APR):

This is the percentage that the bank or lender will charge you as interest. For example, 8.99% is used which is the average rate for those with a good credit score.

Sami’s Insight:

When I was looking for a loan for my fishing boat, I got quotes from a bank, a credit union and a marine finance specialist. Even a small difference in rate can make a difference of thousands in the long term. So it’s worth doing some comparison.

Loan Term: (Years)

The loan term decides your monthly payment and total interest rate. Common terms:

- 5 years

- 10 years (this is the case in the example)

- 15 years

- 20 years (for high-value boats)

Sami’s Experience:

I was initially looking for a longer term as the monthly payment is less. But when the calculator showed the total interest, my eyes opened. Then I chose a shorter term which had a slightly higher monthly payment but saved a lot of money overall. Got the best balance.

Loan Summary: Your Detailed Financial Forecast 📈

After filling in the details in the calculator, the result will be something like this:

- Estimated Payment: $506.49/month

This is the main number that is most important according to your budget. - Total Loan Amount: $40,000

This is the actual amount of the loan after deducting down payment, trade-in and adding taxes/fees. - Total Interest Paid: $20,778.40

This is the extra money that you will pay only for interest. If you can make an extra payment, you can save interest if there is no prepayment penalty. - Total Taxes & Fees: $3,000

These are total extra charges that come in the form of taxes and fees. - Total Cost of the Boat: $73,778.40

This is the final amount you will pay for the boat over its lifetime – including price, taxes, fees, and interest.

Pros and Cons: Is a Boat Loan Your Best Way to Get on the Water? ⚓️

Okay friends, now let’s talk about pros and cons – that is, is taking a boat loan a smart move or not? Just like everything has two aspects, loans also have advantages and disadvantages. So let’s take an honest look:

Pros of Boat Loans 👍

- Get on the Water Sooner:

Finding it difficult to collect all the money at once? Then taking a loan can be a smart option. With this, you can go out in the water on your dream boat without waiting too much. Meaning the dream is fulfilled right now! - Manageable Payments:

Another advantage of taking a loan is that you do not have to pay a large amount at once. You can repay the money little by little through monthly EMIs. With a little planning, it fits in the budget.

Cons of Boat Loans 👎

- Significant Total Interest:

Look, taking a loan seems easy, but if you take a long-term loan, the interest can be quite high. Think about it, by paying little by little for 10-15 years, you can double your money. - Depreciation:

Just like the value of a car depreciates over time, so does the value of a boat. Sometimes, the situation becomes such that the value of the boat depreciates and your loan amount remains high. This is called negative equity—it is a little risky.

Frequently Asked Questions About Boat Loans in Canada ❓

Q1: What’s a typical interest rate for a boat loan in Canada?

For people with a good credit score, the interest rate is usually between 7-10%. But every case is different. Whether the boat is new or old, your salary, credit score—it all matters.

Q2: How long can I get a boat loan for in Canada?

In Canada, you can get a loan term of 5 years to 15 years. And if the boat is a little expensive or a new model, you can get it for up to 20 years. Longer term means lower EMI, but higher interest.

Drop Anchor with Confidence: Calculate Your Boat Loan Today!

See, buying a boat is not just a purchase; it is a lifestyle choice. If you are thinking seriously, do your math first. Open the Boat Loan Calculator once—go to Easyloancalc.com or check the website of your favourite lender.

Try different options—like if you pay a 20% down payment instead of 10%, or reduce the term a bit, then see how the EMI changes. This will give you a clear picture of what your budget allows.

And when the planning is strong, confidence also comes. So, just get the anchor ready, because this summer is going to be filled with memories of your boat ride! The lakes of Canada are waiting for you!

Read Detailed Article: Why Use a Boat Loan / Finance Payment Calculator