Boat Loan Calculator: Payments, Interest & Down Payment

Hello, future boat owners and maritime enthusiasts!

Hi friends, Sami here! If you dream of sailing, enjoying fishing or enjoying the sunset, then owning a boat is an important part of that dream. But before buying a boat, the most important thing is to understand how you will finance the boat. This is where a boat loan calculator becomes your best friend.

Your Nautical Navigator: The Boat Loan Calculator ⚓️

Whether you are looking for a sleek speed boat, a comfortable cruiser, a fishing boat or a luxury yacht – buying a boat is a big financial decision. You will have to understand some important terms like:

- Boat price

- How much down payment should I make?

- What interest rate will I get?

- What will be the loan term?

All these things together decide what your monthly EMI will be and what the total cost of the boat will be.

I remember a friend who was crazy about fishing. He had saved money for a long time, but when the time came to buy the actual boat, trade-ins, taxes, and loan options confused him. He needed a tool that would clearly show what its monthly cost and total interest would be.

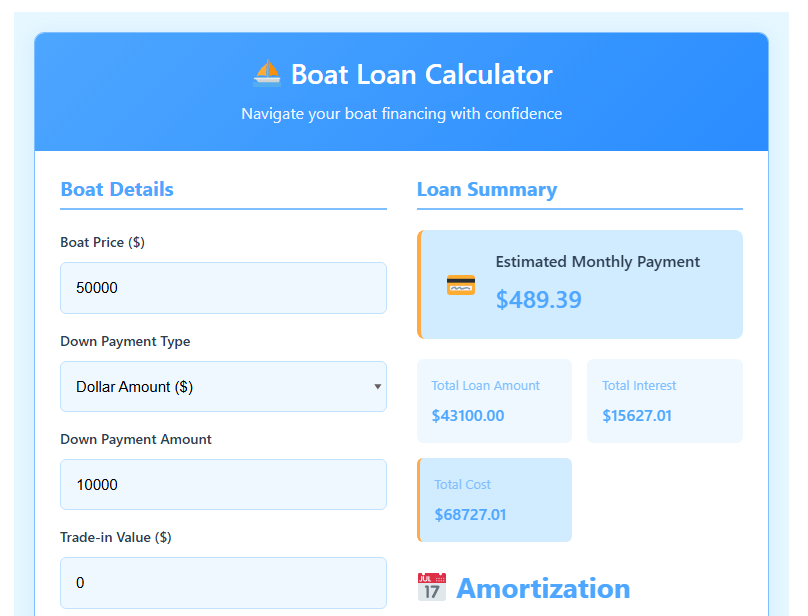

⛵ Boat Loan Calculator

Navigate your boat financing with confidence

Boat Details

Loan Terms

Loan Summary

Estimated Monthly Payment

$0.00

📅 Amortization Schedule

📊 Payment Composition

⛵ Boating Tip

Consider making bi-weekly payments instead of monthly to potentially save on interest and pay off your loan faster!

That is why a Boat Loan Calculator is very helpful. Removing the confusion of all these numbers gives you a clear idea of how much you will pay and which plan fits your budget. The goal of the calculator I have designed on Easyloancalc.com is to give you this clarity – so that you can confidently move towards your dream boat.

What Exactly Does a Boat Loan Calculator Do? 🤔

A good Boat Loan Calculator gives you a complete financial picture of your boat financing. It helps you understand:

- “Boat Loan Calculator with Interest”: It tells you how much interest you will pay during the entire loan duration – i.e., the actual cost of borrowing.

- “Boat Loan Calculator with Down Payment”: Shows how your loan amount and monthly payment change with the down payment.

- “Boat Loan Calculator with Interest Paid”: Here you can see how much total interest you will pay according to different options.

- Estimated Monthly Payment: This is your expected monthly EMI, which you have to fit into your budget.

- Total Loan Amount: Shows how much you will have to finance after combining the boat price, trade-in, down payment and extra costs.

- Total Cost: Final amount you will pay for the boat – boat price + taxes + interest + fees.

Setting Sail: Using My Boat Loan Calculator on Easyloancalc.com 🚤

I have made Easyloancalc.com’s Boat Loan Calculator simple but with details, so that you can accurately estimate your financing. Let’s understand through an example:

Read this Article: Fairstone Loan Calculator

⛵ Boat Details: About Your Dream Vessel

- Boat Price ($) 💲

This is the full selling price of the boat.

Example: $60,000 - Down Payment Type ⬇️

You can enter either a dollar amount or a percentage.

Example: Percentage (%) - Down Payment Amount 💵

If you put 10% then 10% of $60,000 = $6,000

More down payment = less debt = less interest - Trade-in Value ($) 🛥️

If you have an old boat or vehicle that you want to trade, put its value here.

Example: $5,000 - Amount Owed on Trade-in ($) 📉

If we have some loan left on trade-in, write that here.

Example: $2,000 - Sales Tax Rate (%) 📊

Enter the tax rate of your province/state here.

Example: 7% - Other Fees ($) 📜

Add extra charges like Registration, title, and dealer fees here.

Example: $500

Loan Terms: Your Financing Structure

- Interest Rate (% APR) 📈

Here you enter the interest rate of the loan you will receive.

Example: 7.5% - Loan Term (Years) 🗓️

You can choose how many years you will repay the loan – 3, 5, 10 or 15 years.

Example: 15 years

Then click on “Calculate Payment” – and if you want to try a new plan, you can refill using “Reset Values“.

📊 Loan Summary: Your Adventure’s Financial Snapshot

Let’s see what the output is based on your inputs:

- Estimated Monthly Payment: $489.39

This will be your regular EMI every month – you will have to keep this amount in your budget. - Total Loan Amount: $55,700.00

This is the actual amount you are financing (boat price – down payment + taxes + fees – trade-in value). - Total Interest: $15,627.01

This is the extra money you will pay as interest over the entire 15 years. - Total Cost: $68,727.01

This will be your full out-of-pocket expense – boat price + interest + fees + taxes all combined.

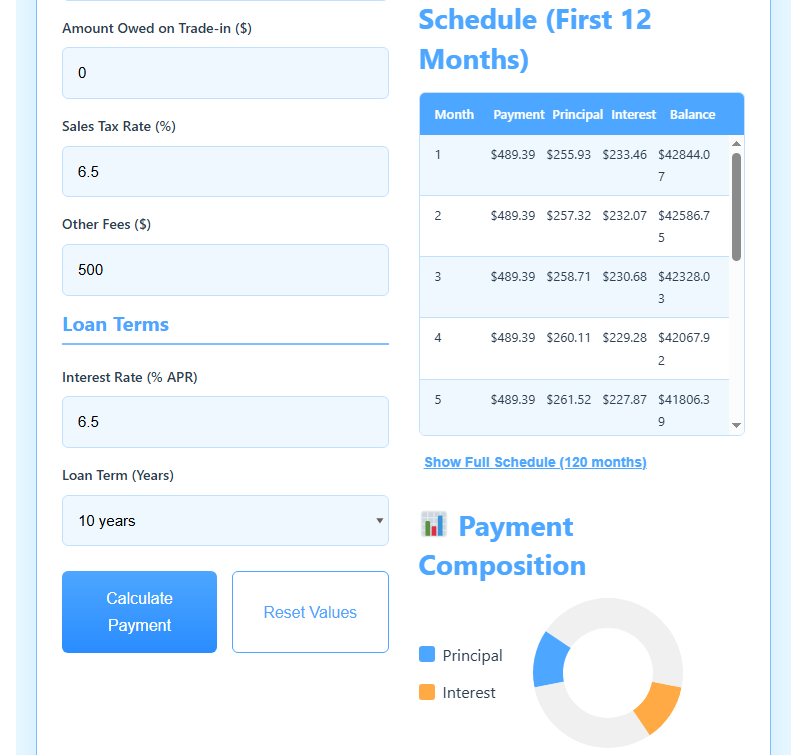

📅 Amortization Schedule (First 12 Months) & 📊 Payment Composition

Amortization Schedule: There is a table that breaks down the monthly payment – how much principal is going and how much interest. You can see how your loan balance is decreasing every month.

Payment Composition Chart: This is a pie chart that shows how much principal and interest are in your total payments. Interest is usually higher at the beginning. Later, the principal starts to increase.

Sami’s Sea-Faring Story: How the Calculator Anchored My Dreams 🚤

I always liked to stay in the water – it was my dream to buy a small sailboat. When I found a used sailboat for $40,000, I wondered how I would manage its monthly payment. I had some savings and also an old boat to trade in.

I then used the Boat Loan Calculator – exactly as you are seeing here.

- Got clarity on how much actual loan I would need to take – after trade-in, taxes, fees etc.

- Tried loan term options – 5-year EMI was high, 15-year interest was very high. The 10-year balance was best.

- Seeing the breakdown of interest vs. principal has encouraged me to make additional principal payments whenever possible.

- With the help of the calculator, my entire financial picture became clear – and I was confident in my decision to buy a boat.

Pros and Cons: Is a Boat Loan Your Ticket to the Water? ✅❌

👍 Pros:

- With boat loans, you can buy a boat without paying a whole lot of money.

- Fixed EMI makes budgeting easy.

- Monthly EMI is less for long terms (15–20 years).

- Paying on time improves your credit score.

- If the boat has a kitchen, toilet and sleeping facility, then you can get tax benefits (consult a tax advisor).

👎 Cons:

- More loans and long-term means more interest.

- The value of the boat decreases with time – sometimes the loan amount is more than the value of the boat.

- Insurance, registration, fuel, storage, and maintenance are all additional expenses.

- In case of default, the lender can take the boat (secured loan).

- Lenders have some specific rules – like minimum credit score, age of the boat etc.

Frequently Asked Questions About Boat Loans ❓

Q1: For how long can I take a boat loan?

Usually 3 to 15 years, sometimes even up to 20 years, especially for high-value boats.

Q2: Is the interest rate of boat loans higher than car loans?

Yes, it can be slightly higher as a boat is considered a luxury item.

Q3: What should be the down payment?

Usually it is 10%–20% of the price of the boat.

Q4: Can I include taxes and fees in the loan?

Yes, you can add taxes, registration and extra charges to the loan amount – but interest will be charged on that too.

Q5: What are the other expenses apart from the loan?

Insurance, fuel, storage, registration, maintenance and accessories like fishing gear etc.

Cast Off Confidently: Calculate Your Boat Loan Today! 🌟

Owning a boat is a dream – and if you use the Boat Loan Calculator, you will get full clarity whether you are financially ready or not.

So don’t wait now – go to Easyloancalc.com and calculate your loan. Enter boat price, down payment, loan term, interest rate and see which plan is best for you.

Get ready for your next boating adventure! ⚓

Detailed Article: Boat Loan Payment Calculator