Your Financial Guide: Fairstone Loan Calculator 🧭

Hello, smart borrowers across Canada!

Hey friends! Sami is speaking. If you have ever thought of getting some extra money – whether it is for some urgent expenses, home renovation, combining old loans or simply managing finances a little better – then a personal loan can help you a lot.

And if you are in Canada, chances are you have heard the name of Fairstone – a reliable lender. But when it comes to taking a loan, one of the first questions that arises is:

“How much will the monthly payment be?”

“And what will be the total cost of the loan?”

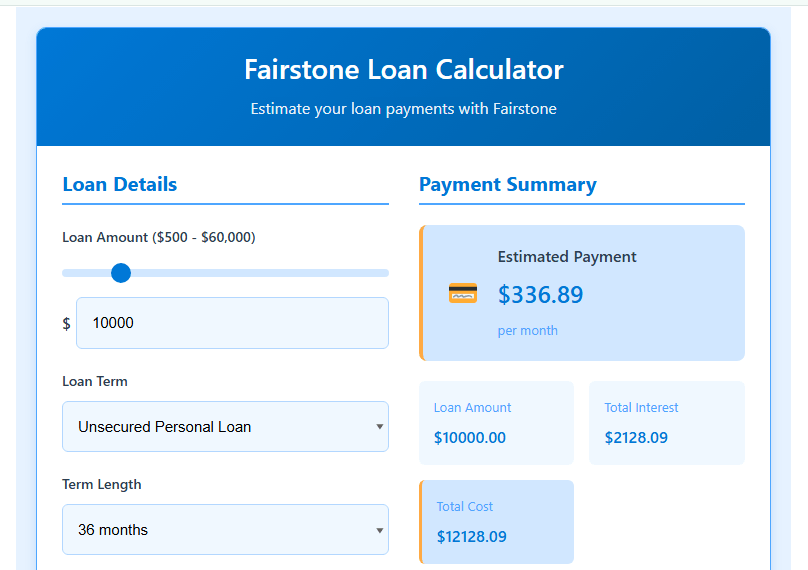

Fairstone Loan Calculator

Estimate your loan payments with Fairstone

Loan Details

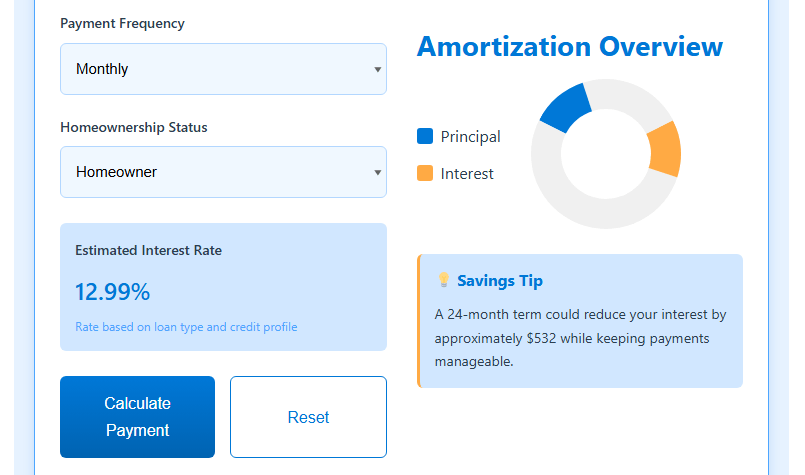

Rate based on loan type and credit profile

Note: This calculator provides estimates only. Actual terms may vary based on credit approval.

No origination fees. Unsecured loans have no prepayment penalties.

Payment Summary

Estimated Payment

$0.00

per month

Amortization Overview

💡 Savings Tip

Choosing a shorter term can significantly reduce your total interest paid.

If the proper details are not there, it all seems confusing — like missing pieces of a puzzle!

Navigating the world of loans can be tricky at times. There are different terms — like loan amount, interest rate, repayment term, payment frequency… and most importantly: the total cost of borrowing.

When you are considering a loan from a trusted lender — like Fairstone — it’s important to understand what you are expecting.

I remember when I was considering a personal loan for my digital studio. I had an estimate of how much money I would need, but I had no idea of the monthly installment and overall cost, so it seemed a bit risky.

Then I used a calculator – where I checked different scenarios – with real numbers! And then I got clarity about which plan would suit me.

This is why tools like the Fairstone Loan Calculator are useful – it works like a financial mirror for you.

What does the Fairstone Loan Calculator do for you? 🤔

This calculator is not a complicated thing. In simple words, it tells you:

✅ Estimated Monthly Payment How many installments you will have to pay every month (or every week, bi-weekly, etc.)

✅ Total Interest: How much extra money you will pay as interest, until the entire loan tenure is completed.

✅ Total Loan Expense: The amount you borrow + interest = your total repayment.

✅ Expectation of Scenario You change the loan amount or term, change the payment frequency – and the calculator immediately tells you how much difference it will make.

Read this Article:Recreational Vehicle Loan Calculator

It is so easy to use a calculator 🗺️

Using a calculator is not rocket science. You just have to give some basic inputs:

1. Loan Amount 💰 : How much do you need? Fairstone offers $500 to $60,000 in loan amounts.

2. Loan Term ⏳ : How long do you want to repay? Unsecured Loans: 6-60 months Secured Loans: 36-120 months

3. Payment Frequency 🔄 : Monthly, semi-monthly, bi-weekly, weekly — choose the one that matches your salary cycle.

4. Loan Type 🔑 : Secured or unsecured? In secured, you have to give an asset (low interest), in unsecured not (interest is a little more).

5. Are you a homeowner or not? 🏠 Some calculators ask you this, too, so that they can show you secured loan options.

What do you get in the output? 📊

When you enter the details and click the Calculate button, you get:

💵 Monthly Payment – Like: $350

💸 Total Interest – Like: $2,500

📊 Total Loan Cost – Like: $12,500

📈 Amortization Schedule (if available) – Breakdown of each payment, how much principal, how much interest.

Sami ki Kahani: How the calculator helped me 💡

When I was expanding my digital content setup, I had to take a loan. Fairstone was on my shortlist.

🔍 Scenario Testing: First I took a short term loan — EMI was high. Term increased — EMI reduced, but interest became high. The calculator immediately told me which one is better.

🛡️ Secured vs Unsecured I had a little equity, so I switched to a secured loan — saved a lot of interest.

🔄 Payment Frequency: I am paid bi-weekly, so I selected the same. Budgeting became easy.

Bottom line: The calculator saved me from taking a loan in the dark. It was possible to make a clear decision.

Fairstone Loan: Pros and Cons ✅❌

👍 Pros

Open to all — a perfect credit score is not necessary.

Use wherever you want – flexible usage

Quick approval – simple application process

Fixed installments – easy budgeting

No origination fee

No prepayment penalty in unsecured loans

👎 Cons

Interest can be high (especially unsecured)

A prepayment penalty can be levied in secured loans

Asset has to be mortgaged (secured)

Risk of over-borrowing

The calculator gives an estimate; the final offer can be slightly different

FAQs – Simple answers to your questions

Q1: On what things does the interest rate depend?

→ Credit score, loan type, province, and your repayment history.

Q2: Does checking a calculator or a quote affect your credit score?

→ No, it’s a soft check — the score is safe.

Q3: What is the difference between secured and unsecured?

→ Secured loans require collateral, leading to lower interest rates. Unsecured loans do not, resulting in higher interest rates.

Q4: Can the loan be repaid quickly?

→ Secured loans (like car loans, where the car is collateral) might have a fee.

Q5: Where do people use Fairstone loans?

→ For debt consolidation, home improvement, emergencies, or starting a business.

Final Words: Smart Planning, Strong Future 🚀

Taking a loan is not bad — taking it without planning is bad. So, first use the calculator on Fairstone or Easyloancalc.com, understand your numbers, and then make a decision.

✅ How many installments will be made?

✅ How much total interest will have to be paid?

✅ Which term is better?

✅ Secured or unsecured — which one fits?

The calculator can answer all these questions — without any confusion.

So plan the next step of your financial journey today itself — with the calculator.

What is your next goal? Reach it confidently!

Read Detailed Article: Loan calculators and tools