Recreational Vehicle Loan Calculator

Hello, adventure-seekers and road-trip dreamers!

Hi friends! Sami is here, and if you have ever imagined yourself driving on the open road — whether it is to explore national parks or enjoy a mobile lifestyle — then the thought of buying an RV (Recreational Vehicle) has definitely come to your mind. Whether it is a small camper van or a luxurious motorhome, an RV opens the door to a whole new world!

But just like there is tension of financing before buying any big thing, a little planning is also necessary for buying an RV.

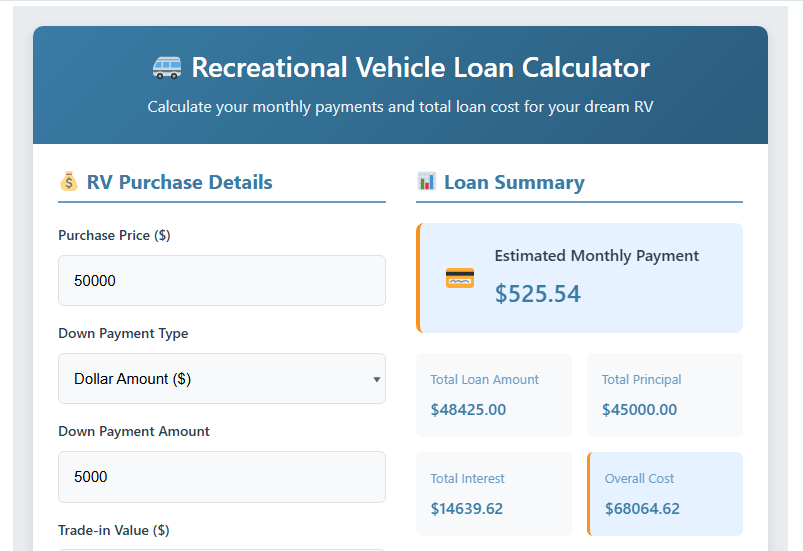

🚐 Recreational Vehicle Loan Calculator

Calculate your monthly payments and total loan cost for your dream RV

💰 RV Purchase Details

📝 Loan Terms

📊 Loan Summary

Estimated Monthly Payment

$0.00

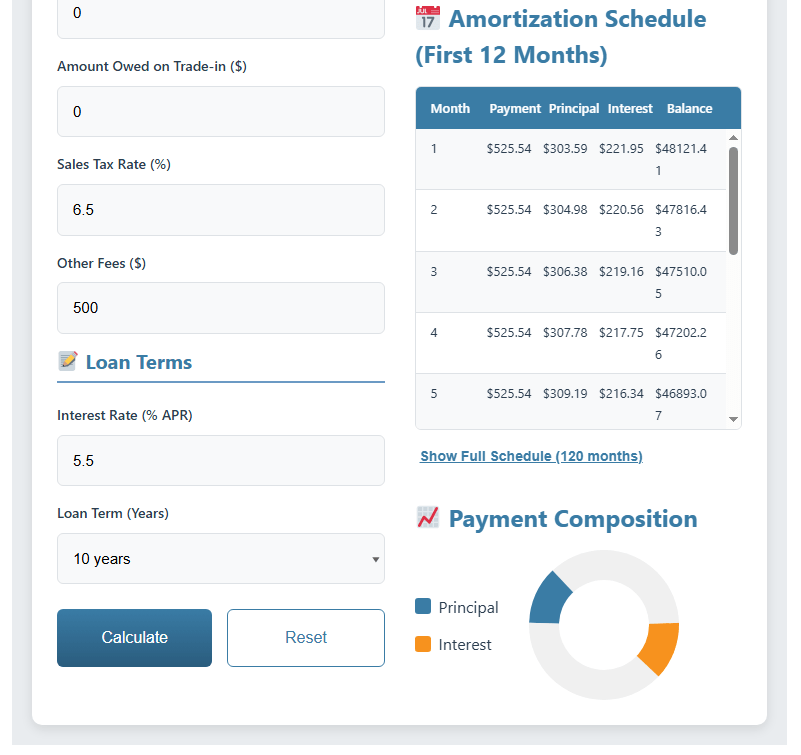

📅 Amortization Schedule (First 12 Months)

📈 Payment Composition

Your Journey Planner: Understanding the Recreational Vehicle Loan Calculator 🛣️🚐

Buying an RV is no ordinary purchase – it’s a lifestyle investment. Whether you are planning weekend getaways or dreaming of full-time RV life, it is important to understand how to arrange the money for this adventure.

You will get terms such as:

- RV price,

- down payment,

- loan duration (term),

- and interest rate.

All of these together determine your monthly RV payment and total loan cost.

I remember a couple of friends of mine, who were camping enthusiasts, decided to upgrade from a tent to a travel trailer. The excitement was full on, but understanding the math of the loan was tricky for them. They needed to be clear on how much they would pay monthly, how much they would pay in total, and how long it would all last.

That’s why I created a simple, powerful Recreational Vehicle Loan Calculator on Easyloancalc.com — so you can confidently plan your RV journey.

Read this Article: Advanced Auto Loan Calculator

What Exactly Does a Recreational Vehicle Loan Calculator Do? 🤔

This calculator is your co-pilot in the wonderful journey of an RV loan. Its job is to give you a clear financial picture. You will know:

- How much will your monthly payment be – how much you will have to pay each month.

- How much interest will you pay on your total interest?

- Overall cost of the RV – total money you will pay for the RV.

- Payment breakdown – how much of each payment is going to the principal and how much interest.

Setting Your Course: Using My Recreational Vehicle Loan Calculator on Easyloancalc.com 📊

I have made this calculator super simple. You just add some basic information, and you will immediately get a realistic cost estimate.

Let’s explain through an example:

📝 Loan Details: Your Dream RV’s Financial Profile

- RV Price ($) 💰

The total selling price of the RV you are looking at.

Example: $75,000 - Down Payment ($) 💵

How much are you paying upfront to start? The higher the down payment, the lower the loan amount and the lower the interest.

Example: $7,500 (10% of price) - Loan Term (months) ⏳

How many months will you repay the loan? RV loans generally last from 5 to 20 years.

Example: 180 months (15 years) - Interest Rate (%) 📈

APR or interest rate is decided based on your credit score, RV type, and loan duration.

Example: 7.5%

After filling in the details, just press “Calculate”. Results will be ready!

📊 Summary: Your Adventure’s Financial Snapshot

Monthly Payment: $629.47

The money you have to pay every month. It should fit into your budget.

Total Interest: $35,304.75

In 15 years, you will pay this much extra money just as interest.

Total Cost: $110,304.75

The actual price of the RV ($75,000) + interest = this is the total money that will come out of your pocket.

Payment Breakdown: Understanding Where Your Money Goes

- Principal: $75,000

- Interest: $35,304.75

This breakdown helps you understand where your money is going — for the actual vehicle or for interest.

Sami’s Road Trip Insights: How a Calculator Fueled My RV Dreams 🌟

I’ve always found myself drawn to the RV lifestyle. When I planned to buy a trailer, just looking at the price wasn’t enough. The calculator showed me the real picture.

My key learnings:

- Impact of loan term: A 20-year loan seemed right initially because the monthly payment was low, but I was shocked when I saw the interest! In shorter terms, I saved a lot.

- Down payment magic: Making a little more down payment reduced the monthly burden. I had already figured this out with the calculator.

- Understanding the Cost Reality: The full cost breakdown was an eye-opener. It helped me prepare a long-term budget.

Pros and Cons: Is an RV Loan the Right Path for Your Adventure? ✅❌

Pros 👍

- Accessible: You don’t have to pay the entire amount at once.

- Fixed payments: The amount is the same every month – easy to plan.

- Longer loan terms: Perfect for low EMIs.

- Credit improvement: Paying on time improves your score.

- Tax benefit (maybe): If the RV qualifies for a second home, the interest can be tax-deductible.

Cons 👎

- More interest: Long term = more interest.

- Depreciation: The value of the RV depreciates over time.

- Extra costs: Insurance, fuel, maintenance – all add up.

- Strict loan criteria: Due to more loans, the credit check is also tougher.

- Risk of default: If the payment is missed, the RV can also be repossessed.

Frequently Asked Questions About RV Loans ❓

Q1: For how many years can the loan be taken?

RV loans are usually for 10 to 20 years. For used RVs, it can be a little less.

Q2: Is the interest on an RV loan higher than a car loan?

Yes, it is a little higher because the loan amount is higher and the term is longer.

Q3: What is the down payment required?

10% to 20% is typical. A higher down payment can also reduce the interest.

Q4: Can taxes/fees also be included in the loan?

Yes, generally you can add sales tax, registration fees, etc. to the loan. The interest will also increase accordingly.

Q5: What else should be included in the budget for RV?

- RV Insurance

- Maintenance & Repairs

- Fuel

- Storage

- Campsite fees

- Accessories

Hit the Open Road Confidently: Calculate Your RV Loan Today! 🌟

Owning an RV can be a life-changing experience. But financial planning is a must first.

So, are you ready for a road trip? Now go to Easyloancalc.com, use the Recreational Vehicle Loan Calculator, and make your dream RV purchase a reality!

Who knows, your next stop will be the Rocky Mountains… or a beachside campsite! 🚐🌲🌅

Detailed Article: Recreational Vehicle (RV) Loan Calculator